Expansion of Retail Channels

The expansion of retail channels in India is playing a crucial role in the growth of the over the-counter-healthcare market. Traditional pharmacies are increasingly complemented by modern retail formats, including supermarkets and online platforms, making OTC products more accessible to consumers. The rise of e-commerce has particularly transformed purchasing behaviors, allowing consumers to buy healthcare products from the comfort of their homes. As of 2025, it is estimated that online sales of OTC products could account for nearly 20% of the total market share. This diversification of retail channels is likely to enhance consumer convenience and drive sales in the over the-counter-healthcare market.

Rising Health Awareness Among Consumers

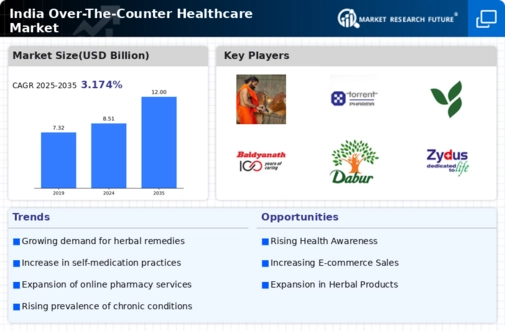

There is a noticeable increase in health awareness among Indian consumers, which is significantly impacting the over the-counter-healthcare market. With access to information through digital platforms, individuals are becoming more proactive about their health. This shift is reflected in the growing sales of OTC products, as consumers seek preventive solutions and self-medication options. Reports indicate that the market for OTC products in India is expected to grow at a CAGR of approximately 10% over the next five years. This heightened awareness is likely to drive innovation and diversification in the over the-counter-healthcare market, as companies strive to meet the evolving needs of informed consumers.

Government Initiatives Promoting Self-Care

Government initiatives aimed at promoting self-care and wellness are influencing the over the-counter-healthcare market in India. Programs that encourage preventive healthcare and self-medication are gaining traction, as they align with the broader goal of reducing the burden on healthcare systems. The government has been actively supporting campaigns that educate the public about the safe use of OTC products. This proactive approach is likely to foster a more favorable environment for the over the-counter-healthcare market, as consumers become more confident in their ability to manage minor health issues independently. Such initiatives may lead to an increase in the acceptance and usage of OTC products across various demographics.

Growing Urbanization and Lifestyle Changes

The rapid urbanization in India is reshaping the healthcare landscape, particularly influencing the over the-counter-healthcare market. As more individuals migrate to urban areas, lifestyle changes become evident, leading to an increase in health issues such as stress, obesity, and chronic diseases. This urban shift is driving demand for OTC products that offer quick relief and convenience. According to recent data, urban populations are projected to reach 600 million by 2031, which may lead to a corresponding rise in OTC product consumption. The over the-counter-healthcare market is likely to benefit from this trend, as urban dwellers often prefer accessible healthcare solutions that can be easily purchased without prescriptions.

Aging Population and Increased Chronic Conditions

India's aging population is a significant driver of the over the-counter-healthcare market. As the demographic landscape shifts, the proportion of elderly individuals is expected to rise, leading to an increase in chronic health conditions such as diabetes and hypertension. This demographic trend necessitates a greater reliance on OTC products for managing these conditions. By 2031, it is projected that the elderly population will exceed 300 million, which may lead to a substantial increase in demand for OTC medications. The over the-counter-healthcare market is likely to adapt to this growing need by offering products tailored to the specific health concerns of older adults.

Leave a Comment