Rising Incidence of Eye Disorders

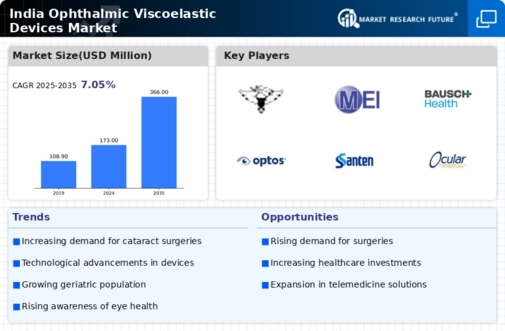

The increasing prevalence of eye disorders in India is a significant driver for the ophthalmic viscoelastic devices market. With an estimated 62 million people suffering from cataracts and a growing aging population, the demand for surgical interventions is on the rise. This surge in eye-related ailments necessitates the use of viscoelastic devices during surgeries to ensure optimal outcomes. Moreover, the World Health Organization has indicated that uncorrected refractive errors affect a substantial portion of the Indian population, further amplifying the need for effective surgical solutions. Consequently, the rising incidence of eye disorders is likely to propel the growth of the ophthalmic viscoelastic devices market, as healthcare providers seek to adopt advanced technologies to address these challenges.

Growing Awareness and Patient Education

Growing awareness and patient education regarding eye health are emerging as vital drivers for the India ophthalmic viscoelastic devices market. Increased access to information through digital platforms and community outreach programs is empowering patients to seek timely medical intervention for eye disorders. As individuals become more informed about the benefits of surgical treatments, the demand for procedures utilizing viscoelastic devices is expected to rise. Moreover, healthcare providers are increasingly focusing on educating patients about the importance of regular eye check-ups and the role of advanced surgical techniques in preserving vision. This heightened awareness is likely to contribute to the growth of the ophthalmic viscoelastic devices market, as more patients opt for surgical solutions to address their eye health concerns.

Technological Advancements in Device Design

The India ophthalmic viscoelastic devices market is experiencing a notable transformation due to rapid technological advancements in device design. Innovations such as the development of cohesive and dispersive viscoelastics are enhancing surgical outcomes in cataract and glaucoma procedures. These advancements not only improve the safety and efficacy of surgeries but also reduce the risk of complications. For instance, the introduction of new formulations that provide better stability and clarity is likely to drive market growth. Furthermore, the integration of smart technologies in surgical devices is anticipated to enhance precision during operations. As a result, the demand for advanced viscoelastic devices is expected to rise, reflecting a shift towards more sophisticated surgical techniques in India.

Increasing Investment in Healthcare Infrastructure

The India ophthalmic viscoelastic devices market is benefiting from increasing investments in healthcare infrastructure. The government and private sector are channeling resources into upgrading hospitals and clinics, particularly in tier-2 and tier-3 cities. This investment is aimed at enhancing the quality of eye care services and expanding the reach of advanced surgical procedures. As more healthcare facilities adopt state-of-the-art technologies, the demand for ophthalmic viscoelastic devices is likely to rise. Furthermore, the establishment of specialized eye hospitals is expected to create a conducive environment for the growth of the market, as these institutions often prioritize the use of advanced surgical materials to ensure better patient outcomes.

Government Initiatives and Healthcare Accessibility

Government initiatives aimed at improving healthcare accessibility are playing a crucial role in the growth of the India ophthalmic viscoelastic devices market. The Indian government has launched various programs to enhance eye care services, particularly in rural areas, where access to quality healthcare remains limited. Initiatives such as the National Programme for Control of Blindness and Visual Impairment are designed to increase awareness and provide affordable treatment options. These efforts are likely to boost the demand for ophthalmic surgeries, consequently driving the need for viscoelastic devices. Additionally, the implementation of policies that promote public-private partnerships in healthcare is expected to facilitate the availability of advanced surgical technologies, further supporting market expansion.