Government Initiatives and Funding

The Indian government has been actively promoting research and development in the field of nanomedicine through various initiatives and funding programs. This support is crucial for the growth of the nanomedicine market, as it encourages innovation and collaboration among academic institutions, research organizations, and industry players. For instance, the Department of Biotechnology has allocated substantial funds to support projects focused on nanotechnology applications in healthcare. Such initiatives not only enhance the research landscape but also attract private investments, further stimulating market growth. The government's commitment to advancing healthcare technology is likely to create a favorable environment for the commercialization of nanomedicine products, thereby expanding their availability and accessibility to the Indian population.

Rising Prevalence of Chronic Diseases

The increasing incidence of chronic diseases in India, such as cancer, diabetes, and cardiovascular disorders, is driving the demand for innovative treatment options. The nanomedicine market is poised to benefit from this trend, as nanotechnology offers targeted drug delivery systems that enhance therapeutic efficacy while minimizing side effects. According to recent estimates, chronic diseases account for approximately 60% of all deaths in India, highlighting the urgent need for advanced medical solutions. This growing health crisis is likely to propel investments in nanomedicine research and development, fostering a more robust market environment. As healthcare providers seek to improve patient outcomes, the integration of nanomedicine into treatment protocols appears increasingly essential, potentially leading to a more sustainable healthcare system in the country.

Technological Advancements in Nanotechnology

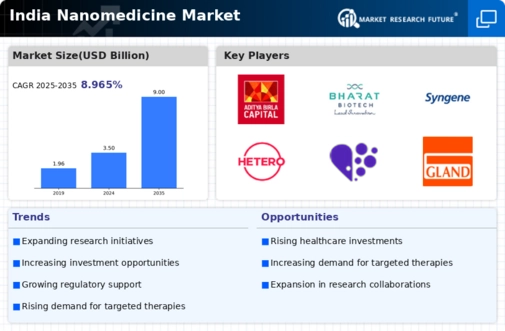

Rapid advancements in nanotechnology are significantly influencing the nanomedicine market in India. Innovations in nanomaterials, such as nanoparticles and nanocarriers, are enhancing drug delivery systems, improving the bioavailability of therapeutics, and enabling targeted therapies. The market is witnessing a surge in the development of novel nanomedicine applications, including diagnostics and imaging techniques. As of 2025, the market for nanomedicine in India is projected to reach approximately $5 billion, driven by these technological breakthroughs. Furthermore, the integration of artificial intelligence and machine learning in nanomedicine research is expected to streamline the drug development process, making it more efficient and cost-effective. This technological evolution is likely to attract more stakeholders to the nanomedicine market, fostering a competitive landscape.

Growing Investment in Healthcare Infrastructure

The expansion of healthcare infrastructure in India is a critical driver for the nanomedicine market. With increasing investments in hospitals, clinics, and research facilities, there is a growing demand for advanced medical technologies, including nanomedicine solutions. The Indian healthcare sector is projected to reach $372 billion by 2022, indicating a robust growth trajectory. This investment trend is likely to facilitate the adoption of nanomedicine in clinical settings, as healthcare providers seek to incorporate cutting-edge technologies to improve patient care. Additionally, the establishment of specialized centers for nanomedicine research and treatment is expected to enhance the overall market landscape, providing a platform for innovation and collaboration among various stakeholders.

Rising Awareness and Acceptance of Nanomedicine

There is a notable increase in awareness and acceptance of nanomedicine among healthcare professionals and patients in India. Educational initiatives and outreach programs are playing a pivotal role in informing stakeholders about the benefits and potential of nanomedicine. As patients become more informed about advanced treatment options, the demand for nanomedicine solutions is likely to rise. This growing acceptance is further supported by successful case studies and clinical trials demonstrating the efficacy of nanomedicine in treating various diseases. The increasing recognition of nanomedicine as a viable therapeutic approach is expected to drive market growth, as healthcare providers are more inclined to recommend these innovative solutions to their patients. Consequently, the nanomedicine market is likely to experience a surge in adoption rates, contributing to its overall expansion.