Regulatory Support and Initiatives

The regulatory landscape in India is evolving to support the growth of the molecular diagnostics transplant market. The Indian government has implemented various initiatives aimed at enhancing the regulatory framework for diagnostic products. For instance, the introduction of the Medical Device Rules in 2017 has facilitated a more structured approval process for molecular diagnostic tests. This regulatory support is crucial as it fosters innovation and encourages manufacturers to invest in research and development. Additionally, the establishment of the National Organ and Tissue Transplant Organization (NOTTO) has further strengthened the framework for transplant diagnostics, ensuring that the industry adheres to high standards of safety and efficacy.

Rising Incidence of Chronic Diseases

The increasing prevalence of chronic diseases in India is a significant driver for the molecular diagnostics transplant market. Conditions such as diabetes, hypertension, and liver diseases are on the rise, leading to a higher demand for organ transplants. According to the Indian Council of Medical Research, the number of organ transplants has increased by approximately 20% annually, highlighting the urgent need for effective diagnostic solutions. Molecular diagnostics play a crucial role in assessing organ compatibility and monitoring post-transplant outcomes. As the population ages and the burden of chronic diseases escalates, the demand for advanced diagnostic tools in the transplant sector is expected to grow, further propelling the industry forward.

Growing Demand for Personalized Medicine

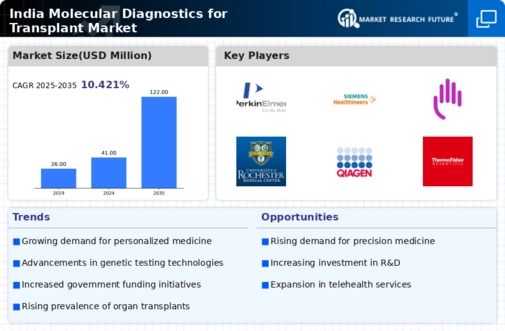

The increasing emphasis on personalized medicine is significantly influencing the India molecular diagnostics transplant market. As healthcare shifts towards tailored treatment approaches, the demand for molecular diagnostic tests that can predict individual responses to therapies is on the rise. This trend is particularly evident in transplant medicine, where understanding a patient's genetic makeup can lead to more effective immunosuppressive strategies. Market data indicates that the personalized medicine segment is projected to grow at a compound annual growth rate (CAGR) of 15% over the next five years. This growth is likely to drive investments in molecular diagnostics, as healthcare providers seek to enhance patient care through customized treatment plans.

Increased Investment in Healthcare Infrastructure

The Indian government is making substantial investments in healthcare infrastructure, which is likely to benefit the molecular diagnostics transplant market. Initiatives such as the National Health Mission and the Ayushman Bharat scheme aim to enhance healthcare access and quality across the country. These investments are expected to improve laboratory facilities and expand the availability of molecular diagnostic tests in both urban and rural areas. Furthermore, public-private partnerships are emerging as a viable model for advancing diagnostic capabilities. As healthcare infrastructure improves, the demand for molecular diagnostics in transplant procedures is anticipated to rise, creating new opportunities for growth within the industry.

Technological Advancements in Molecular Diagnostics

The India molecular diagnostics transplant market is experiencing a surge in technological advancements that enhance diagnostic accuracy and efficiency. Innovations such as next-generation sequencing (NGS) and polymerase chain reaction (PCR) techniques are becoming increasingly prevalent. These technologies enable rapid and precise identification of genetic markers associated with transplant compatibility, thereby improving patient outcomes. According to recent data, the adoption of NGS in India has increased by approximately 30% over the past two years, reflecting a growing trend towards advanced diagnostic solutions. Furthermore, the integration of artificial intelligence in molecular diagnostics is anticipated to streamline workflows and reduce turnaround times, making it a pivotal driver in the industry.