Public Awareness Campaigns

Public awareness campaigns regarding meningococcal disease and its prevention are crucial for the India meningococcal vaccines market. Various non-governmental organizations and health authorities are actively engaged in educating the public about the risks associated with meningococcal infections. These campaigns often highlight the importance of vaccination as a preventive measure, which has been shown to increase vaccination rates significantly. For instance, initiatives that provide information on the symptoms and consequences of meningococcal disease have led to a greater understanding among parents about the necessity of vaccinating their children. As awareness continues to grow, it is expected that more families will opt for meningococcal vaccines, thereby driving demand in the market. The ongoing efforts to disseminate information about the disease are likely to have a lasting impact on vaccination uptake.

Rising Healthcare Expenditure

The increasing healthcare expenditure in India is another significant driver for the India meningococcal vaccines market. As the country experiences economic growth, both public and private sectors are investing more in healthcare infrastructure and services. According to recent data, healthcare spending in India is projected to reach USD 372 billion by 2022, reflecting a growing commitment to improving health outcomes. This surge in investment is likely to facilitate the procurement and distribution of meningococcal vaccines, making them more accessible to the population. Additionally, as healthcare awareness rises, individuals are more inclined to seek vaccinations, further propelling market growth. The combination of increased funding and heightened public interest in preventive healthcare suggests a promising outlook for the meningococcal vaccines market.

Government Vaccination Programs

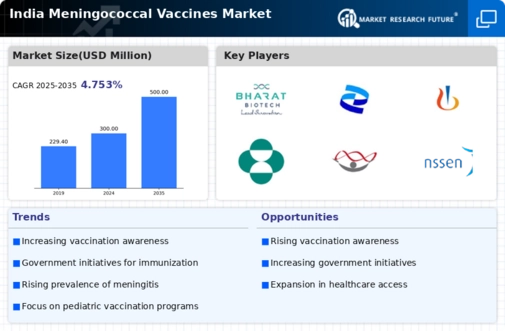

Government initiatives play a pivotal role in shaping the India meningococcal vaccines market. The Indian government has implemented various vaccination programs aimed at controlling infectious diseases, including meningococcal infections. The National Immunization Program includes meningococcal vaccines as part of its routine immunization schedule in certain high-risk areas. This strategic approach not only enhances vaccine accessibility but also encourages public participation in vaccination drives. Furthermore, the government has allocated substantial funding to support these initiatives, which is anticipated to increase the market's growth potential. With the aim of achieving herd immunity, the government is likely to expand its vaccination campaigns, thereby driving demand for meningococcal vaccines across the nation.

Advancements in Vaccine Technology

Advancements in vaccine technology are poised to influence the India meningococcal vaccines market positively. The development of new vaccine formulations and delivery methods has the potential to enhance the efficacy and safety of meningococcal vaccines. Recent innovations, such as conjugate vaccines, have shown promise in providing long-lasting immunity with fewer doses. These technological improvements are likely to increase public confidence in vaccination, as parents seek effective solutions to protect their children from meningococcal disease. Moreover, as manufacturers invest in research and development, the introduction of novel vaccines could expand the market by offering more options to healthcare providers. The ongoing evolution of vaccine technology suggests a dynamic future for the meningococcal vaccines market in India.

Increasing Incidence of Meningococcal Disease

The rising incidence of meningococcal disease in India appears to be a critical driver for the India meningococcal vaccines market. Reports indicate that the country has witnessed sporadic outbreaks, particularly in regions with dense populations. The World Health Organization has noted that meningococcal infections can lead to severe health complications, including meningitis and septicemia. This alarming trend has prompted health authorities to prioritize vaccination programs. As a result, the demand for meningococcal vaccines is likely to increase, with projections suggesting a growth rate of approximately 8% annually in the coming years. The heightened awareness of the disease's impact on public health is expected to further bolster the market, as families seek preventive measures to protect their children.