Innovative Product Development

Innovation plays a crucial role in the medicated confectionery market, as manufacturers continuously seek to develop new and appealing products. The introduction of unique flavors, textures, and health benefits is essential to attract consumers. For instance, the incorporation of herbal ingredients and natural sweeteners is becoming more prevalent, catering to the growing demand for clean-label products. This trend is supported by the fact that approximately 60% of consumers in India express a preference for products with natural ingredients. As companies invest in research and development, the medicated confectionery market is likely to expand, offering a diverse range of options that meet the evolving preferences of health-conscious consumers.

Rising Demand for Functional Foods

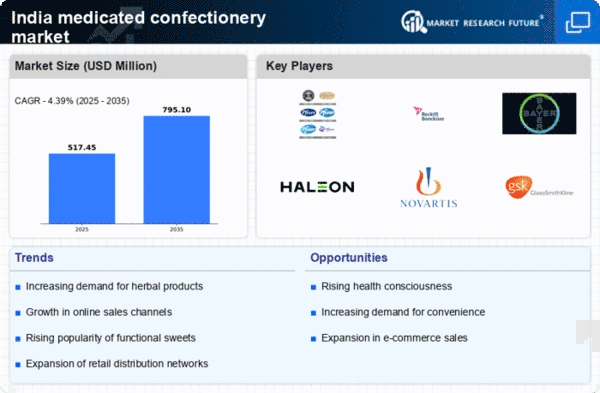

The increasing awareness of health and wellness among consumers in India is driving the demand for functional foods, including the medicated confectionery market. Consumers are increasingly seeking products that offer health benefits beyond basic nutrition. This trend is reflected in the growth of the medicated confectionery market, which is projected to expand at a CAGR of approximately 8% over the next five years. The appeal of these products lies in their ability to combine taste with therapeutic benefits, making them an attractive option for health-conscious individuals. As more consumers prioritize their health, the medicated confectionery market is likely to see a surge in demand, particularly among younger demographics who are more inclined to explore innovative health solutions.

Growing E-commerce and Online Retail

The rise of e-commerce in India is transforming the way consumers access products, including those in the medicated confectionery market. With the increasing penetration of the internet and smartphones, online shopping has become a preferred method for many consumers. This shift is particularly beneficial for niche markets, as it allows for greater visibility and accessibility of specialized products. The medicated confectionery market is expected to benefit from this trend, as online platforms provide a convenient way for consumers to explore and purchase health-oriented confectioneries. It is estimated that online sales in this sector could account for up to 25% of total sales by 2026, reflecting the growing importance of digital channels in reaching health-conscious consumers.

Regulatory Support for Health Products

Regulatory frameworks in India are increasingly supportive of health-oriented products, which positively impacts the medicated confectionery market. The Food Safety and Standards Authority of India (FSSAI) has been proactive in establishing guidelines that promote the safety and efficacy of functional foods. This regulatory support encourages manufacturers to innovate and develop new medicated confectionery products that comply with safety standards. As a result, the market is likely to see a rise in consumer trust and acceptance of these products, potentially leading to a market growth rate of around 6% over the next few years. The alignment of regulatory policies with consumer health trends is expected to foster a conducive environment for the medicated confectionery market.

Increased Focus on Preventive Healthcare

The shift towards preventive healthcare in India is significantly influencing the medicated confectionery market. As healthcare costs rise, consumers are becoming more proactive about their health, seeking products that can help prevent ailments rather than just treat them. This trend is evident in the growing popularity of medicated confectionery items that offer immunity-boosting properties or relief from common ailments. The market is expected to witness a growth rate of around 7% annually as consumers increasingly opt for convenient and enjoyable ways to incorporate health benefits into their daily routines. This focus on preventive measures is likely to enhance the appeal of the medicated confectionery market, positioning it as a viable alternative to traditional pharmaceuticals.