Growing Awareness of Patient Safety

There is a growing awareness of patient safety among healthcare providers in India, which is significantly influencing the medical simulation market. As hospitals and clinics strive to minimize medical errors and improve patient outcomes, simulation training is increasingly viewed as an essential component of staff development. This heightened focus on safety is prompting healthcare organizations to invest in simulation technologies that facilitate realistic training scenarios. The medical simulation market is likely to expand as institutions prioritize training that emphasizes safe practices and effective communication among healthcare teams. This trend underscores the critical role of simulation in fostering a culture of safety within the healthcare sector.

Support from Healthcare Regulatory Bodies

Support from healthcare regulatory bodies is emerging as a crucial driver for the medical simulation market in India. Regulatory agencies are recognizing the importance of simulation-based training in enhancing the quality of healthcare services. As a result, there is an increasing push for the incorporation of simulation in accreditation standards for medical education and training programs. This regulatory support is likely to encourage more institutions to adopt simulation technologies, thereby expanding the medical simulation market. Furthermore, as compliance with these standards becomes essential, the demand for high-quality simulation solutions is expected to rise, fostering growth in this sector.

Technological Innovations in Simulation Tools

Technological innovations are playing a pivotal role in shaping the medical simulation market in India. The advent of virtual reality (VR) and augmented reality (AR) technologies has revolutionized the way medical training is conducted. These advanced tools offer immersive experiences that enhance learning outcomes for healthcare professionals. As institutions recognize the benefits of these technologies, investments in simulation tools are expected to rise. The medical simulation market is projected to witness substantial growth, with estimates suggesting an increase in market value to over $200 million by 2027. This trend indicates a shift towards more sophisticated training methodologies that prioritize realism and interactivity.

Integration of Simulation in Medical Education

The integration of simulation into medical education is transforming the landscape of training in India. Medical schools and nursing programs are increasingly adopting simulation-based curricula to provide students with hands-on experience in a controlled environment. This shift is indicative of a broader trend towards experiential learning, which is believed to enhance retention and application of knowledge. The medical simulation market is benefiting from this trend, as educational institutions allocate more resources towards acquiring simulation equipment and technologies. Furthermore, the emphasis on practical skills in medical education is likely to drive the demand for simulation solutions, contributing to the overall growth of the medical simulation market in India.

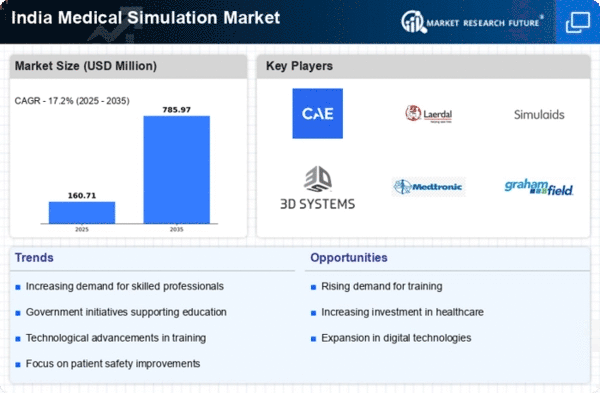

Rising Demand for Skilled Healthcare Professionals

The medical simulation market in India is experiencing a notable surge in demand for skilled healthcare professionals. This demand is driven by the increasing complexity of medical procedures and the need for effective training methods. As healthcare institutions strive to enhance the competency of their workforce, simulation-based training has emerged as a preferred approach. Reports indicate that the market for medical simulation in India is projected to grow at a CAGR of approximately 15% over the next few years. This growth reflects the recognition of simulation as a vital tool for improving clinical skills and ensuring patient safety. Consequently, educational institutions and hospitals are investing in advanced simulation technologies, thereby propelling the medical simulation market forward.