Rising Biopharmaceutical Sector

The biopharmaceutical sector in India is experiencing rapid growth, which is likely to drive the live cell-imaging market. With an increasing number of biopharmaceutical companies focusing on innovative drug development, the demand for advanced imaging technologies is expected to rise. In 2025, the biopharmaceutical market in India is projected to reach approximately $100 billion, indicating a robust investment in research and development. This growth is anticipated to create a substantial need for live cell-imaging solutions, as researchers require precise imaging techniques to monitor cellular processes in real-time. Consequently, the expansion of the biopharmaceutical sector is a significant driver for the live cell-imaging market, as it fosters the adoption of advanced imaging technologies in laboratories across the country.

Growing Academic Research Initiatives

Academic research institutions in India are increasingly investing in advanced imaging technologies, which is expected to bolster the live cell-imaging market. With a rise in research initiatives focusing on cellular biology, cancer research, and regenerative medicine, the demand for live cell imaging is likely to surge. In 2025, funding for research in life sciences is anticipated to exceed $5 billion, reflecting a commitment to advancing scientific knowledge. This influx of funding enables institutions to acquire state-of-the-art imaging equipment, thereby enhancing their research capabilities. As a result, the growth of academic research initiatives serves as a crucial driver for the live cell-imaging market, fostering innovation and discovery in various scientific fields.

Emergence of Startups in Biotechnology

The emergence of biotechnology startups in India is contributing to the growth of the live cell-imaging market. These startups are often at the forefront of innovation, developing novel imaging technologies and applications. With the Indian government promoting entrepreneurship through various initiatives, the number of biotech startups is on the rise. In 2025, it is estimated that the biotechnology sector will attract investments exceeding $10 billion, further stimulating the demand for advanced imaging solutions. Startups are likely to leverage live cell imaging to enhance their research and development processes, thereby driving the adoption of these technologies in the market. This trend indicates a vibrant ecosystem that supports the growth of the live cell-imaging market.

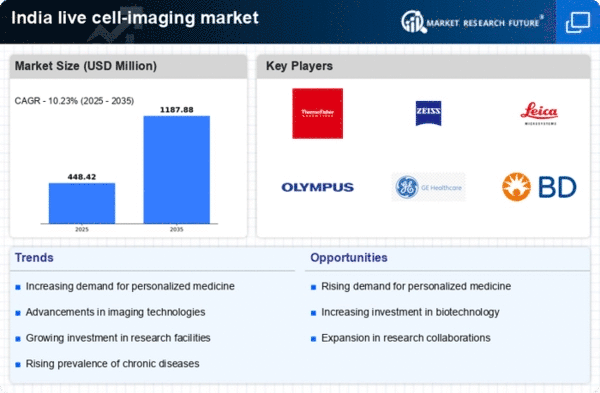

Increased Focus on Personalized Medicine

The shift towards personalized medicine in India is influencing the live cell-imaging market. As healthcare providers and researchers aim to tailor treatments to individual patients, the need for advanced imaging techniques becomes paramount. Live cell imaging allows for the observation of cellular responses to various treatments, facilitating the development of personalized therapies. The Indian healthcare market is projected to grow at a CAGR of 22% from 2020 to 2025, highlighting the increasing emphasis on personalized approaches. This trend is likely to propel the demand for live cell-imaging technologies, as they provide critical insights into cellular behavior and treatment efficacy, thereby enhancing the overall quality of patient care.

Increased Collaboration Between Industry and Academia

Collaboration between industry and academic institutions in India is fostering advancements in the live cell-imaging market. Such partnerships often lead to the development of innovative imaging technologies and applications that can be commercialized. In 2025, it is projected that collaborative research initiatives will account for over 30% of funding in the life sciences sector, highlighting the importance of these alliances. By working together, industry players and academic researchers can share resources, knowledge, and expertise, which is likely to enhance the capabilities of live cell imaging. This collaborative approach not only accelerates technological advancements but also drives the overall growth of the live cell-imaging market, as new solutions are developed and brought to market.