Supportive Government Policies

The Indian government is actively promoting biotechnology and related fields through supportive policies and initiatives. This favorable regulatory environment is encouraging research and development in the live cell-encapsulation market. Initiatives such as the Biotechnology Industry Research Assistance Council (BIRAC) are providing funding and resources to startups and established companies alike. Furthermore, the government is streamlining regulatory processes to facilitate quicker approvals for innovative therapies. This proactive approach is likely to enhance the growth prospects of the live cell-encapsulation market, as companies can bring their products to market more efficiently. As a result, the combination of government support and industry innovation is expected to create a thriving ecosystem for live cell encapsulation in India.

Rising Investment in Biotechnology

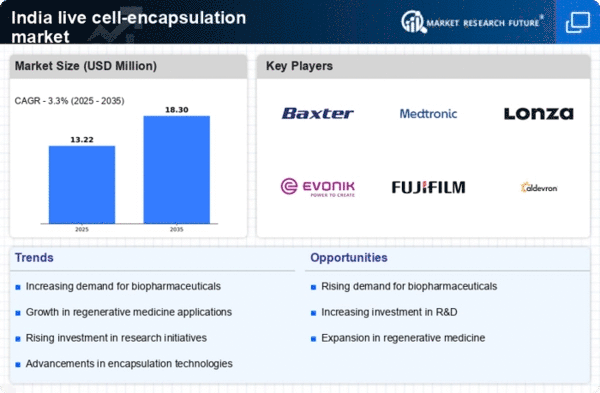

The live cell-encapsulation market in India is experiencing a surge in investment from both public and private sectors. This influx of capital is primarily directed towards research and development initiatives aimed at enhancing encapsulation technologies. The Indian government has recognized biotechnology as a key area for growth, allocating substantial funding to support innovative projects. In 2023, the biotechnology sector in India received investments exceeding $2 billion, indicating a robust interest in advancing technologies that can improve healthcare outcomes. This financial backing is likely to foster the development of novel encapsulation techniques, thereby driving the growth of the live cell-encapsulation market. As more companies enter this space, competition will intensify, potentially leading to lower costs and increased accessibility of encapsulated cell therapies for patients.

Advancements in Drug Delivery Systems

Innovations in drug delivery systems are playing a crucial role in shaping the live cell-encapsulation market. The development of sophisticated delivery mechanisms that utilize encapsulated cells is enhancing the efficacy of therapeutic agents. These advancements allow for controlled release and targeted delivery, which are essential for maximizing treatment effectiveness. In India, research institutions and pharmaceutical companies are collaborating to create novel drug delivery systems that incorporate live cell encapsulation. This collaboration is expected to yield products that not only improve patient compliance but also reduce side effects associated with traditional therapies. As these technologies mature, they are likely to expand the applications of encapsulated cells, further driving the growth of the live cell-encapsulation market.

Increasing Prevalence of Chronic Diseases

The rise in chronic diseases in India is a significant driver for the live cell-encapsulation market. Conditions such as diabetes, cancer, and cardiovascular diseases are becoming increasingly prevalent, necessitating innovative treatment solutions. According to recent health reports, approximately 77 million people in India are currently living with diabetes, a figure that is projected to rise. This growing patient population is driving demand for advanced therapeutic options, including those offered by the live cell-encapsulation market. Encapsulated cell therapies have the potential to provide targeted treatment, improving patient outcomes and quality of life. As healthcare providers seek effective solutions to manage chronic conditions, the live cell-encapsulation market is poised for substantial growth in response to this pressing need.

Growing Awareness of Regenerative Medicine

There is a notable increase in awareness regarding regenerative medicine among healthcare professionals and patients in India. This growing understanding is fostering interest in innovative treatment modalities, including those offered by the live cell-encapsulation market. Regenerative medicine focuses on repairing or replacing damaged tissues and organs, and encapsulated cells are emerging as a viable solution for various medical conditions. Educational initiatives and conferences are being organized to disseminate knowledge about the benefits of regenerative therapies. As awareness continues to rise, more healthcare providers are likely to consider incorporating encapsulated cell therapies into their treatment protocols, thereby propelling the live cell-encapsulation market forward.