Emergence of Managed Services

The IT Service-Management Market in India is experiencing a notable emergence of managed services as organizations seek to offload certain IT functions to specialized providers. This trend is driven by the desire for cost efficiency and access to expertise that may not be available in-house. Managed service providers (MSPs) are increasingly offering comprehensive IT service management solutions that allow businesses to focus on their core competencies while ensuring that their IT infrastructure is well-managed. Recent market analysis suggests that the managed services segment is expected to grow by 20% over the next few years, reflecting a shift in how organizations approach IT service management. This evolution indicates a growing reliance on external expertise to enhance service delivery and operational efficiency.

Rising Demand for IT Efficiency

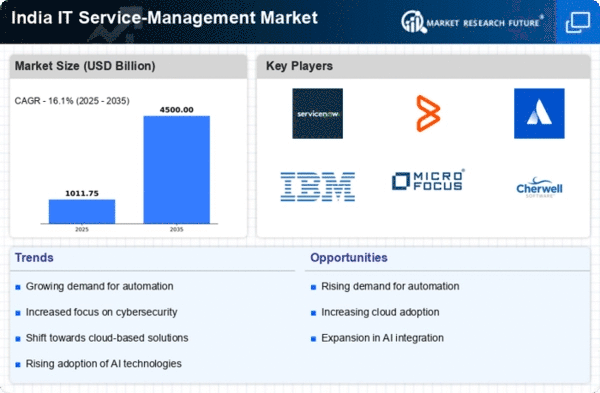

The IT Service-Management Market in India is experiencing a notable surge in demand for enhanced operational efficiency. Organizations are increasingly recognizing the need to streamline their IT processes to reduce costs and improve service delivery. According to recent data, the market is projected to grow at a CAGR of approximately 12% over the next five years. This growth is driven by the necessity for businesses to optimize their IT resources and ensure that they can respond swiftly to changing market conditions. As companies strive to maintain a competitive edge, the focus on efficient IT service management becomes paramount, leading to increased investments in tools and technologies that facilitate better service delivery.

Integration of Advanced Analytics

The IT Service-Management Market in India is witnessing a significant integration of advanced analytics into service management processes. Organizations are increasingly leveraging data analytics to gain insights into service performance and customer satisfaction. This trend is indicative of a broader movement towards data-driven decision-making in IT service management. By utilizing analytics, businesses can identify trends, predict issues, and optimize service delivery. The market for analytics-driven IT service management solutions is projected to grow at a CAGR of 18%, as companies recognize the value of data in enhancing service quality and operational efficiency. This integration not only improves service outcomes but also empowers organizations to make informed strategic decisions.

Shift Towards Remote Work Solutions

The IT Service-Management Market in India is witnessing a significant shift towards solutions that support remote work. As organizations adapt to new work environments, there is a growing need for IT service management tools that enable seamless collaboration and communication among remote teams. This trend is reflected in the increasing adoption of cloud-based service management platforms, which allow for greater flexibility and accessibility. Recent statistics indicate that the market for remote IT service solutions is expected to expand by 15% annually, as businesses prioritize the implementation of systems that can support a distributed workforce. This shift not only enhances productivity but also necessitates robust IT service management frameworks to ensure consistent service quality.

Increased Focus on Compliance and Governance

In the context of the IT Service-Management Market in India, there is an escalating emphasis on compliance and governance. Organizations are increasingly required to adhere to various regulatory standards, which necessitates the implementation of comprehensive IT service management practices. This focus on compliance is driving the demand for solutions that can help organizations manage their IT assets and services in accordance with legal and regulatory requirements. The market is projected to see a growth rate of around 10% as companies invest in IT service management tools that facilitate compliance tracking and reporting. This trend underscores the importance of governance in IT operations, as businesses seek to mitigate risks associated with non-compliance.