Advancements in Biotechnology

Technological advancements in biotechnology are driving innovation within the insulin biosimilars market. The development of sophisticated manufacturing processes and analytical techniques has enhanced the quality and efficacy of biosimilars. In India, companies are increasingly investing in research and development to create high-quality biosimilars that meet regulatory standards. This focus on innovation not only improves product offerings but also fosters competition within the market, leading to better pricing and availability for patients. As the insulin biosimilars market continues to evolve, these advancements are likely to play a pivotal role in shaping the future landscape of diabetes management in India.

Rising Healthcare Expenditure

The increase in healthcare expenditure in India is a significant driver for the insulin biosimilars market. As the government and private sectors allocate more resources to healthcare, there is a growing emphasis on providing affordable treatment options for chronic diseases like diabetes. The insulin biosimilars market stands to gain from this trend, as increased funding can lead to better healthcare infrastructure and access to medications. Moreover, with healthcare spending projected to rise by approximately 10% annually, the demand for cost-effective biosimilars is likely to grow. This trend indicates a positive outlook for the insulin biosimilars market, as it aligns with the broader goals of improving health outcomes and reducing financial burdens on patients.

Cost-Effectiveness of Biosimilars

Cost considerations are paramount in the Indian healthcare landscape, making the cost-effectiveness of biosimilars a significant driver for the insulin biosimilars market. Biosimilars typically offer a lower price point compared to their reference biologics, which can lead to substantial savings for both patients and healthcare systems. In India, where healthcare affordability is a pressing concern, the introduction of biosimilars can potentially reduce treatment costs by up to 30-40%. This financial incentive encourages healthcare providers to prescribe biosimilars, thereby increasing their market penetration. The insulin biosimilars market is thus likely to witness accelerated growth as more patients gain access to these affordable alternatives, ultimately improving treatment adherence and health outcomes.

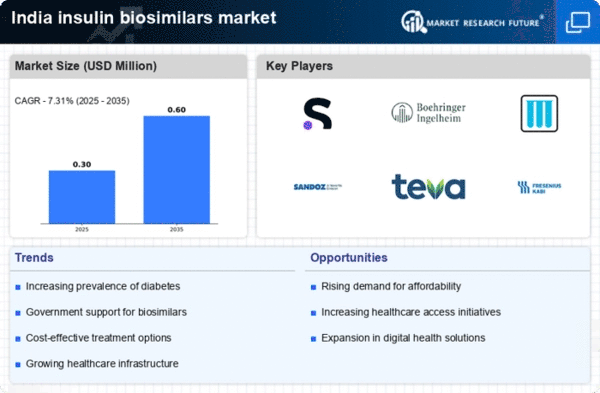

Increasing Prevalence of Diabetes

The rising incidence of diabetes in India is a crucial driver for the insulin biosimilars market. With an estimated 77 million people living with diabetes, the demand for effective and affordable insulin therapies is surging. This growing patient population necessitates the availability of biosimilars, which offer a cost-effective alternative to branded insulin products. As healthcare costs continue to escalate, the insulin biosimilars market is likely to expand, providing patients with more accessible treatment options. Furthermore, the increasing prevalence of diabetes-related complications underscores the need for timely and effective management, further propelling the market's growth. The insulin biosimilars market is thus positioned to play a vital role in addressing this public health challenge.

Regulatory Support for Biosimilars

The regulatory environment in India is becoming increasingly supportive of biosimilars, which is a key driver for the insulin biosimilars market. The Indian government has established guidelines that facilitate the approval and commercialization of biosimilars, thereby encouraging pharmaceutical companies to invest in this sector. This regulatory framework aims to ensure the safety and efficacy of biosimilars while promoting competition in the market. As a result, the insulin biosimilars market is expected to benefit from a more streamlined approval process, leading to a greater variety of products available to patients. This supportive regulatory landscape is likely to enhance market growth and accessibility.