Expansion of Biotechnology Sector

India's biotechnology sector is experiencing rapid growth, which significantly impacts the gene expression-analysis market. The sector is projected to reach a valuation of $100 billion by 2025, driven by advancements in research and development. This expansion fosters a conducive environment for the adoption of gene expression technologies, as biopharmaceutical companies increasingly rely on these tools for drug discovery and development. The gene expression-analysis market benefits from collaborations between academic institutions and biotech firms, leading to innovative applications in genomics. As the biotechnology landscape evolves, the demand for sophisticated gene expression analysis tools is likely to increase, further propelling market growth.

Increased Awareness of Genetic Testing

There is a growing awareness among the Indian population regarding the benefits of genetic testing, which is driving the gene expression-analysis market. As individuals become more informed about the role of genetics in health and disease, the demand for genetic testing services is rising. This trend is reflected in the increasing number of diagnostic laboratories offering gene expression analysis services. The gene expression-analysis market is likely to expand as healthcare providers incorporate genetic testing into routine medical practice. Additionally, educational campaigns and outreach programs are expected to further enhance public understanding, potentially leading to a market growth rate of 10% in the coming years.

Rising Prevalence of Genetic Disorders

The increasing incidence of genetic disorders in India is a crucial driver for the gene expression-analysis market. With an estimated 6-8 million people affected by genetic conditions, the demand for advanced diagnostic tools is surging. This trend is likely to propel investments in gene expression technologies, as healthcare providers seek to enhance their diagnostic capabilities. The gene expression-analysis market is expected to witness a growth rate of approximately 15% annually, driven by the need for precise genetic testing and personalized treatment plans. Furthermore, government initiatives aimed at improving healthcare infrastructure may further stimulate market growth, as they encourage research and development in genetic diagnostics.

Government Support for Genomic Research

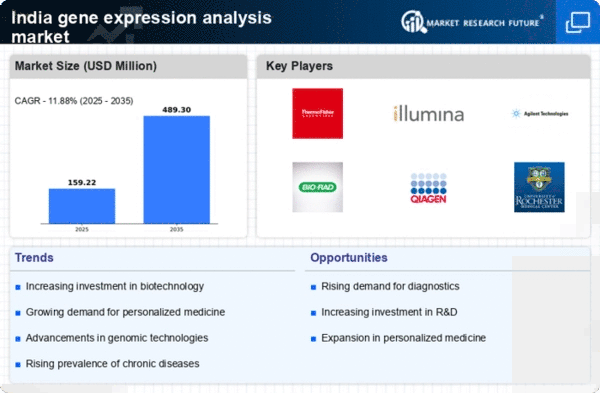

The Indian government is actively promoting genomic research through various initiatives, which serves as a significant driver for the gene expression-analysis market. Programs aimed at enhancing research capabilities and funding for genomics projects are becoming more prevalent. For instance, the establishment of dedicated research centers and funding schemes has led to increased collaboration between public and private sectors. This support is expected to boost the gene expression-analysis market, as researchers gain access to advanced technologies and resources. The government's commitment to fostering innovation in genomics may result in a more robust market, with an anticipated growth rate of around 12% over the next few years.

Emergence of Advanced Analytical Technologies

The introduction of advanced analytical technologies is transforming the gene expression-analysis market in India. Innovations such as next-generation sequencing (NGS) and real-time PCR are enhancing the accuracy and efficiency of gene expression studies. These technologies enable researchers to conduct high-throughput analyses, which is essential for large-scale genomic projects. The gene expression-analysis market is poised for growth as academic and research institutions adopt these cutting-edge tools. Furthermore, the integration of artificial intelligence and machine learning in data analysis is likely to streamline workflows and improve outcomes. As these technologies become more accessible, the market may experience a compound annual growth rate of approximately 14%.