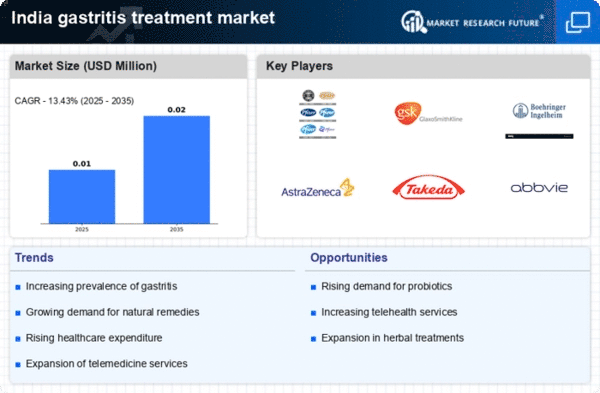

Rising Healthcare Expenditure

India's healthcare expenditure has been on an upward trajectory, which positively impacts the gastritis treatment market. With the government's focus on improving healthcare infrastructure and increasing public health spending, more resources are allocated to gastrointestinal health. Reports indicate that healthcare spending in India is projected to reach approximately 3.6% of GDP by 2025. This increase allows for better access to treatments, medications, and healthcare services for gastritis patients. As more individuals can afford healthcare, the demand for effective gastritis treatments is expected to rise, driving market growth. The gastritis treatment market stands to benefit from this trend as healthcare becomes more accessible to the general population.

Expansion of Telemedicine Services

The expansion of telemedicine services in India has transformed the way patients access healthcare, including treatments for gastritis. With the increasing penetration of smartphones and internet connectivity, patients can now consult healthcare providers remotely. This trend is particularly beneficial for those in rural or underserved areas, where access to specialized care may be limited. Telemedicine facilitates timely diagnosis and treatment recommendations for gastritis, thereby enhancing patient outcomes. As telehealth continues to grow, the gastritis treatment market is expected to see an increase in patient engagement and adherence to treatment plans, ultimately driving market growth.

Increasing Prevalence of Gastritis

The rising incidence of gastritis in India is a primary driver for the gastritis treatment market. Factors such as dietary habits, stress, and lifestyle changes contribute to this increase. According to health surveys, approximately 20-30% of the Indian population experiences gastritis symptoms at some point in their lives. This growing prevalence necessitates effective treatment options, thereby expanding the market. As awareness about gastritis and its complications increases, more individuals seek medical advice, leading to a higher demand for various treatment modalities. The gastritis treatment market is likely to see a surge in both pharmaceutical and non-pharmaceutical solutions, catering to the diverse needs of patients across the country.

Emergence of Innovative Treatment Options

The gastritis treatment market is witnessing the emergence of innovative treatment options, which is a crucial driver for market growth. Advances in medical research and technology have led to the development of new medications and therapies aimed at effectively managing gastritis. For instance, the introduction of novel proton pump inhibitors and herbal formulations has provided patients with more choices for treatment. Additionally, ongoing clinical trials and research initiatives are likely to yield further advancements in gastritis management. As these innovative options become available, they are expected to attract more patients seeking effective solutions, thereby propelling the gastritis treatment market forward.

Growing Awareness of Gastrointestinal Health

There is a notable increase in awareness regarding gastrointestinal health among the Indian population, which serves as a significant driver for the gastritis treatment market. Educational campaigns and health initiatives by both government and private sectors have led to a better understanding of gastritis and its implications. As individuals become more informed about the symptoms and potential complications of untreated gastritis, they are more likely to seek medical intervention. This heightened awareness is reflected in the growing number of consultations with healthcare professionals for gastrointestinal issues. Consequently, the gastritis treatment market is likely to expand as more patients pursue effective treatment options to manage their conditions.