Rising Healthcare Expenditure

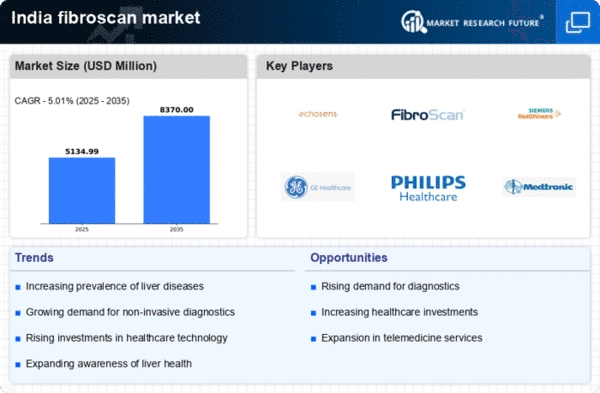

India's increasing healthcare expenditure is a notable driver for the fibroscan market. With the government and private sectors investing more in healthcare infrastructure, the availability of advanced diagnostic tools is improving. Reports indicate that healthcare spending in India is projected to reach approximately $370 billion by 2025, reflecting a growth rate of around 12% annually. This financial commitment is likely to facilitate the adoption of innovative technologies, including fibroscan devices, in hospitals and clinics. As healthcare facilities upgrade their diagnostic capabilities, the demand for non-invasive liver assessment tools will likely rise, thereby boosting the fibroscan market. The trend towards prioritizing preventive healthcare further underscores the importance of early diagnosis, which fibroscan technology can provide.

Growing Awareness of Liver Health

The increasing awareness of liver health among the Indian population is a significant driver for the fibroscan market. Public health campaigns and educational initiatives are shedding light on the importance of liver function and the risks associated with liver diseases. As individuals become more informed about the implications of liver health, there is a corresponding rise in demand for effective diagnostic solutions. The fibroscan technology, known for its non-invasive nature, is gaining traction as a preferred method for liver assessment. This heightened awareness is likely to lead to more individuals seeking screening and diagnostic services, thereby expanding the market. Furthermore, healthcare providers are increasingly recommending fibroscan assessments as part of routine check-ups, which could further enhance the market's growth trajectory.

Supportive Regulatory Environment

The supportive regulatory environment in India is a key driver for the fibroscan market. The government has been actively promoting the adoption of advanced medical technologies to improve healthcare delivery. Regulatory bodies are streamlining the approval processes for innovative diagnostic devices, making it easier for manufacturers to introduce fibroscan technology into the market. This proactive approach is likely to encourage investment in research and development, leading to enhanced product offerings. As more healthcare facilities gain access to fibroscan devices, the market is expected to experience significant growth. Additionally, the alignment of regulatory policies with international standards may further boost confidence among healthcare providers and patients, thereby fostering a favorable environment for the fibroscan market.

Increasing Prevalence of Liver Diseases

The rising incidence of liver diseases in India is a crucial driver for the fibroscan market. Conditions such as hepatitis, fatty liver disease, and cirrhosis are becoming more common, affecting millions. According to recent health reports, liver diseases account for a significant portion of morbidity and mortality in the country. This alarming trend necessitates effective diagnostic tools, such as fibroscan technology, which offers a non-invasive method to assess liver stiffness and fibrosis. The growing awareness among healthcare providers and patients about liver health is likely to propel the demand for fibroscan devices, thereby expanding the market. As the healthcare system in India continues to evolve, the need for accurate and timely diagnosis of liver conditions will further enhance the relevance of the fibroscan market.

Technological Integration in Healthcare

The integration of advanced technologies in healthcare is a pivotal driver for the fibroscan market. Innovations such as telemedicine, artificial intelligence, and data analytics are transforming the way healthcare services are delivered in India. The fibroscan technology, which utilizes ultrasound-based elastography, is increasingly being integrated with digital health platforms to enhance diagnostic accuracy and patient management. This technological synergy not only improves the efficiency of liver assessments but also facilitates remote monitoring and follow-up care. As healthcare providers adopt these integrated solutions, the demand for fibroscan devices is expected to rise. The potential for improved patient outcomes through timely and accurate diagnostics further underscores the relevance of the fibroscan market in the evolving healthcare landscape.