Emergence of Niche Markets

The EMS ODM market is increasingly characterized by the emergence of niche markets., driven by specific consumer needs and preferences. As industries such as healthcare, automotive, and renewable energy expand, there is a growing demand for specialized electronic solutions. This trend suggests that ems odm market players may need to diversify their offerings to cater to these niche segments. The potential for growth in these areas is substantial, with estimates indicating that niche markets could account for up to 30% of the overall ems odm market by 2030. Consequently, companies that successfully identify and target these niches may gain a competitive edge, positioning themselves favorably in the evolving landscape.

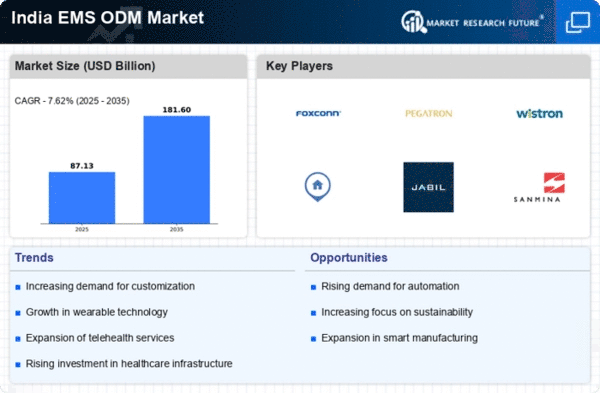

Shift Towards Smart Manufacturing

The EMS ODM market is witnessing a transformative shift towards smart manufacturing practices., driven by advancements in automation and data analytics. Companies are increasingly adopting Industry 4.0 technologies to enhance operational efficiency and reduce production costs. This trend is likely to result in a 20% increase in productivity within the ems odm market over the next few years. By leveraging smart technologies, manufacturers can optimize supply chains and improve product quality, which is essential in meeting the demands of a competitive market. As a result, The EMS ODM market is expected to evolve, with companies investing in innovative solutions to stay ahead of the curve..

Government Initiatives and Policies

The Indian government is actively promoting the manufacturing sector through various initiatives, which significantly impacts the ems odm market. Programs such as 'Make in India' aim to boost local manufacturing and attract foreign investment. These initiatives are likely to enhance the competitiveness of domestic ems odm market players, enabling them to scale operations and innovate. Additionally, the government has introduced incentives for electronics manufacturing, which could lead to a projected increase in production capacity by 15% over the next few years. Such supportive policies are expected to create a conducive environment for the growth of the ems odm market, fostering collaboration between local and international firms.

Rising Demand for Consumer Electronics

The ems odm market in India is experiencing a notable surge in demand for consumer electronics, driven by increasing disposable incomes and a growing middle class. As consumers seek advanced features and personalized products, manufacturers are compelled to adapt their offerings. The market for consumer electronics is projected to grow at a CAGR of approximately 10% over the next five years. This growth is likely to stimulate the ems odm market, as companies strive to meet the evolving preferences of tech-savvy consumers. Furthermore, the proliferation of smart devices and the Internet of Things (IoT) is expected to further enhance the demand for customized electronic solutions, thereby creating new opportunities for ems odm market players.

Growing Focus on Quality and Compliance

Quality assurance and regulatory compliance are becoming paramount in the ems odm market, particularly as consumer awareness increases. Companies are now prioritizing adherence to international quality standards to enhance their market reputation and customer trust. This focus on quality is likely to drive investments in quality control processes and certifications, which could increase operational costs by approximately 5%. However, the long-term benefits of improved product reliability and customer satisfaction may outweigh these costs. As a result, The EMS ODM market is expected to see a shift towards more stringent quality measures., which could enhance competitiveness and foster innovation among market players.