Expansion of 5G Network Infrastructure

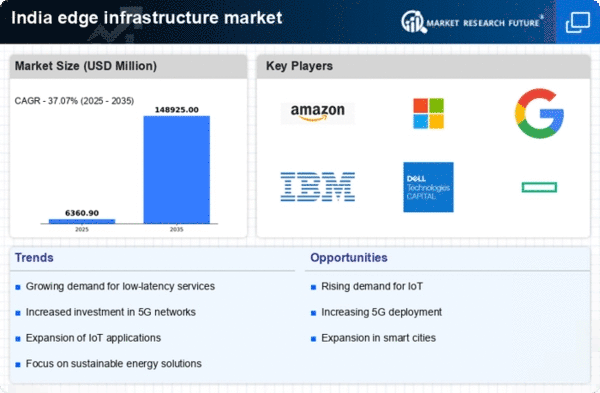

The rollout of 5G networks across India is significantly influencing the edge infrastructure market. With 5G technology offering enhanced bandwidth and reduced latency, it enables a plethora of new applications that require real-time data processing. The edge infrastructure market is poised to benefit from this expansion, as businesses leverage 5G to deploy IoT devices and applications that demand immediate data access. Reports indicate that the number of 5G connections in India is expected to reach 500 million by 2025, further propelling the need for robust edge infrastructure. This technological advancement not only facilitates faster data transmission but also supports the development of smart cities and autonomous vehicles, thereby creating a fertile ground for edge computing solutions.

Rising Demand for Real-Time Data Processing

The edge infrastructure market in India is experiencing a notable surge in demand. This demand is for real-time data processing capabilities. As businesses increasingly rely on data-driven decision-making, the need for low-latency processing becomes paramount. Industries such as manufacturing, healthcare, and retail are adopting edge computing solutions to enhance operational efficiency. According to recent estimates, the edge infrastructure market is projected to grow at a CAGR of approximately 30% over the next five years. This growth is driven by the necessity for immediate data analysis, which is crucial for applications like predictive maintenance and customer experience optimization. Consequently, organizations are investing in edge infrastructure to ensure they can process data closer to the source, thereby reducing latency and improving responsiveness in their operations.

Increased Investment in Smart City Initiatives

India's commitment to developing smart cities is driving substantial investments in the edge infrastructure market. The government has launched various initiatives aimed at enhancing urban infrastructure through technology. These smart city projects often rely on edge computing to manage data from numerous sensors and devices deployed throughout urban environments. As of 2025, it is estimated that the Indian government will allocate over $1 billion towards smart city projects, which will necessitate the implementation of edge infrastructure to ensure efficient data processing and management. This trend indicates a growing recognition of the importance of localized data processing in urban planning and management, thereby fostering the growth of the edge infrastructure market.

Surge in Remote Work and Digital Transformation

The shift towards remote work and digital transformation in India is reshaping the edge infrastructure market. Organizations are increasingly adopting cloud-based solutions and remote collaboration tools, which require efficient data processing capabilities. This trend has led to a heightened focus on edge computing, as businesses seek to enhance their IT infrastructure to support remote operations. The edge infrastructure market is likely to see a growth rate of around 25% as companies invest in solutions that facilitate seamless connectivity and data access for remote employees. This transformation underscores the necessity for businesses to implement edge infrastructure that can support distributed workforces while maintaining data security and operational efficiency.

Growing Need for Enhanced Data Security Solutions

As cyber threats become more sophisticated, the edge infrastructure market in India is witnessing a growing emphasis on enhanced data security solutions. Organizations are increasingly aware of the vulnerabilities associated with centralized data processing and are turning to edge computing to mitigate these risks. By processing data closer to the source, businesses can reduce the attack surface and improve their overall security posture. The market for edge security solutions is projected to grow by approximately 20% in the coming years, driven by the need for real-time threat detection and response capabilities. This trend highlights the critical role of edge infrastructure in safeguarding sensitive data and ensuring compliance with regulatory requirements.