Regulatory Framework Enhancements

The evolving regulatory framework in India is playing a pivotal role in shaping the drug repurposing market. The Central Drugs Standard Control Organization (CDSCO) has been streamlining approval processes for repurposed drugs, thereby reducing the time required for market entry. This regulatory support is crucial, as it encourages pharmaceutical companies to invest in repurposing initiatives. In recent years, the CDSCO has introduced guidelines that facilitate faster clinical trials for repurposed drugs, which can lead to quicker access for patients. As the regulatory landscape continues to evolve, it is expected that the drug repurposing market will experience accelerated growth, driven by increased confidence among stakeholders in the approval process.

Cost-Effectiveness of Drug Repurposing

The economic advantages associated with drug repurposing are driving its growth in the Indian market. Developing new drugs can be prohibitively expensive, often exceeding $2 billion and taking over a decade. In contrast, repurposing existing drugs can significantly reduce development costs and timelines. This cost-effectiveness is particularly appealing to Indian pharmaceutical companies, which are increasingly focusing on innovative solutions to enhance their product portfolios. The drug repurposing market is thus positioned to thrive as stakeholders recognize the potential for quicker returns on investment while addressing unmet medical needs. Furthermore, the Indian government has been promoting initiatives to support affordable healthcare, which aligns with the principles of drug repurposing.

Rising Burden of Non-Communicable Diseases

The increasing prevalence of non-communicable diseases (NCDs) in India is a significant driver for the drug repurposing market. With conditions such as diabetes, cardiovascular diseases, and cancer on the rise, the healthcare system faces immense pressure. The World Health Organization indicates that NCDs account for approximately 60% of all deaths in India. This alarming statistic highlights the urgent need for effective treatment options. Drug repurposing offers a cost-effective and time-efficient approach to address these health challenges, as existing drugs can be quickly evaluated for new therapeutic uses. Consequently, the drug repurposing market is likely to expand as pharmaceutical companies and researchers seek to leverage existing compounds to combat the growing burden of NCDs.

Collaboration Between Academia and Industry

The collaboration between academic institutions and the pharmaceutical industry is emerging as a vital driver for the drug repurposing market. In India, numerous universities and research organizations are engaging in partnerships with pharmaceutical companies to facilitate the discovery of new drug applications. These collaborations often result in the pooling of resources, expertise, and data, which can accelerate the drug repurposing process. As a result, the drug repurposing market is likely to benefit from innovative research outcomes and the development of new treatment options. Furthermore, such partnerships can enhance the credibility of repurposed drugs, making them more appealing to healthcare providers and patients.

Growing Investment in Research and Development

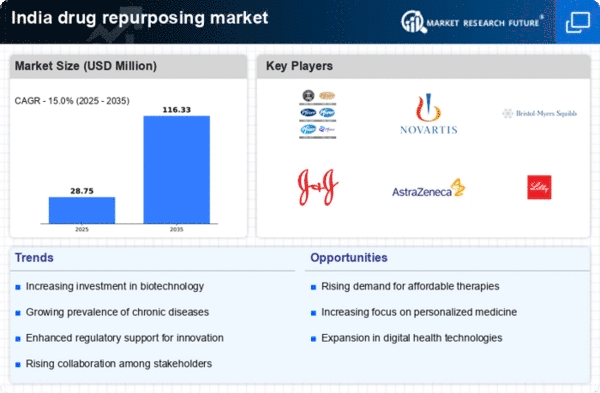

Investment in research and development (R&D) within the Indian pharmaceutical sector is a crucial driver for the drug repurposing market. The Indian government has been actively encouraging R&D through various initiatives, including tax incentives and grants. In 2025, the Indian pharmaceutical industry is projected to reach a market size of $65 billion, with a substantial portion allocated to R&D activities. This influx of funding enables researchers to explore new applications for existing drugs, thereby fostering innovation in the drug repurposing market. As more resources are dedicated to R&D, the potential for discovering novel therapeutic uses for established medications increases, ultimately benefiting patients and healthcare providers alike.