Increasing Energy Security

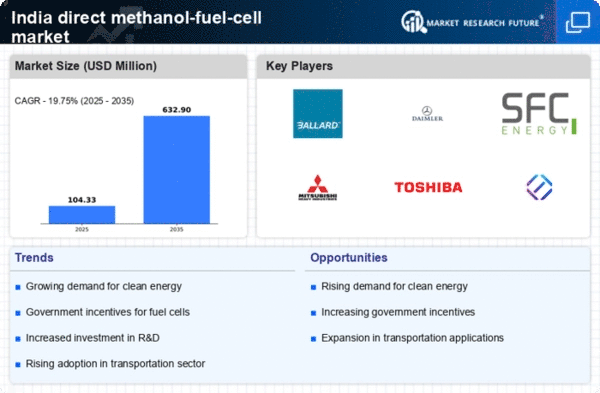

The direct methanol-fuel-cell market in India is experiencing significant growth due to the increasing emphasis on energy security. As the nation seeks to reduce its dependence on fossil fuels, the adoption of alternative energy sources becomes paramount. Direct methanol fuel cells offer a viable solution, providing a clean and efficient energy source. The Indian government has set ambitious targets for renewable energy, aiming for 500 GW of non-fossil fuel capacity by 2030. This push towards energy independence is likely to drive investments in the direct methanol-fuel-cell market, as industries and consumers alike seek reliable and sustainable energy solutions.

Focus on Sustainable Development Goals

India's commitment to the United Nations Sustainable Development Goals (SDGs) is influencing various sectors, including the direct methanol-fuel-cell market. The emphasis on clean energy and climate action aligns with the objectives of SDG 7, which aims to ensure access to affordable, reliable, sustainable, and modern energy for all. As industries and governments work towards achieving these goals, the demand for clean energy technologies, such as direct methanol fuel cells, is expected to rise. This alignment with global sustainability initiatives may lead to increased funding and support for the direct methanol-fuel-cell market, fostering innovation and growth.

Rising Urbanization and Transportation Needs

Urbanization in India is accelerating, with projections indicating that by 2031, over 600 million people will reside in urban areas. This rapid urban growth is creating a pressing demand for efficient transportation solutions. The direct methanol-fuel-cell market stands to benefit from this trend, as fuel cells are increasingly recognized for their potential in powering public transport systems and personal vehicles. The Indian automotive sector is projected to reach a market size of $300 billion by 2026, and integrating direct methanol fuel cells could enhance the sustainability of this growth, aligning with the country's environmental goals.

Technological Advancements in Fuel Cell Efficiency

Technological advancements are playing a crucial role in enhancing the efficiency of direct methanol fuel cells. Research and development efforts in India are focused on improving the performance and reducing the costs associated with fuel cell technologies. Innovations in catalyst materials and membrane technology are expected to drive the market forward. The direct methanol-fuel-cell market could see a reduction in production costs by up to 20% over the next few years, making it a more attractive option for consumers and industries. This technological progress is likely to stimulate market growth and adoption across various applications.

Government Incentives for Clean Technology Adoption

The Indian government is actively promoting the adoption of clean technologies through various incentives and subsidies. Initiatives such as the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme aim to encourage the use of alternative energy sources, including direct methanol fuel cells. By providing financial support and tax benefits, the government is creating a conducive environment for the direct methanol-fuel-cell market to flourish. As these incentives continue to evolve, they are expected to attract investments and drive the development of infrastructure necessary for widespread adoption.