Emergence of IoT Devices

The proliferation of Internet of Things (IoT) devices in India is creating new opportunities for the deep packet-inspection market. As more devices become interconnected, the volume of data generated is expected to increase dramatically. This interconnectedness raises concerns regarding data security and privacy, prompting organizations to adopt deep packet inspection technologies to monitor and secure IoT communications. The Indian IoT market is projected to grow to $15 billion by 2025, indicating a substantial increase in the number of devices that will require effective monitoring solutions. Consequently, the deep packet-inspection market is likely to expand as businesses seek to implement comprehensive security measures to protect their IoT ecosystems from potential vulnerabilities.

Rising Adoption of Cloud Services

The shift towards cloud services in India is influencing the deep packet-inspection market as organizations increasingly migrate their operations to cloud environments. This transition necessitates robust security measures to protect data stored in the cloud. Deep packet inspection technologies are essential for monitoring traffic and ensuring the integrity of data in cloud applications. As businesses embrace cloud solutions, the demand for deep packet inspection is likely to rise, driven by the need for enhanced visibility and control over cloud-based communications. The Indian cloud market is anticipated to reach $10 billion by 2025, further emphasizing the potential for growth in the deep packet-inspection market as organizations seek to secure their cloud infrastructures.

Growth of Internet Traffic and Data Consumption

The deep packet-inspection market is significantly influenced by the exponential growth of internet traffic and data consumption in India. With the increasing penetration of smartphones and the expansion of broadband services, data usage has skyrocketed. Reports indicate that mobile data consumption in India is expected to reach 20 exabytes per month by 2025. This surge in data traffic necessitates the deployment of deep packet inspection technologies to manage and analyze the vast amounts of data flowing through networks. As service providers strive to optimize network performance and ensure quality of service, the demand for deep packet-inspection solutions is likely to rise. This trend underscores the critical role that deep packet inspection plays in enabling efficient data management and enhancing user experience in an increasingly data-driven environment.

Increasing Demand for Network Security Solutions

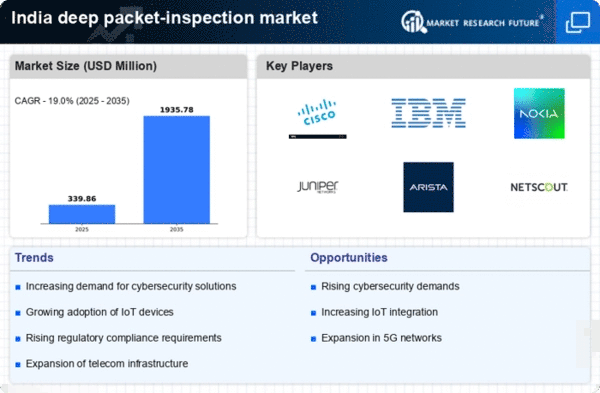

The deep packet-inspection market in India is experiencing a surge in demand for advanced network security solutions. As cyber threats become more sophisticated, organizations are increasingly adopting deep packet inspection technologies to enhance their security posture. This trend is driven by the need to protect sensitive data and maintain customer trust. According to recent estimates, the market for network security solutions in India is projected to grow at a CAGR of approximately 15% over the next five years. This growth is indicative of the rising awareness among businesses regarding the importance of safeguarding their networks. Consequently, the deep packet-inspection market is poised to benefit from this heightened focus on security, as organizations seek to implement robust measures to counteract potential threats.

Regulatory Frameworks and Compliance Requirements

The deep packet-inspection market is also being shaped by the evolving regulatory frameworks and compliance requirements in India. Government initiatives aimed at enhancing cybersecurity and data protection are prompting organizations to adopt more stringent security measures. Compliance with regulations such as the Information Technology Act and the Personal Data Protection Bill necessitates the implementation of advanced monitoring solutions. As organizations strive to meet these regulatory demands, the adoption of deep packet inspection technologies is expected to increase. This trend highlights the importance of ensuring compliance while safeguarding sensitive information, thereby driving growth in the deep packet-inspection market as businesses seek to align their operations with legal requirements.