Expansion of Distribution Channels

the expansion of distribution channels in India plays a crucial role in the growth of the cough syrup market. With the rise of e-commerce and online pharmacies, consumers now have greater access to a variety of cough syrup products. This shift is particularly beneficial in rural areas, where traditional pharmacies may be limited. The convenience of online shopping, coupled with competitive pricing, is likely to attract more consumers to purchase cough syrups through digital platforms. As a result, the cough syrup market is expected to experience an increase in sales volume, potentially reaching a market value of $500 million by 2026. This trend indicates a significant transformation in how consumers access healthcare products.

Innovations in Product Formulation

Innovations in product formulation are emerging as a key driver in the cough syrup market. Manufacturers are increasingly investing in research and development to create new formulations that cater to diverse consumer needs. This includes the introduction of sugar-free options, formulations for children, and those with added health benefits such as immunity boosters. Such innovations not only attract health-conscious consumers but also address specific market segments, potentially increasing market share. The cough syrup market may witness a notable shift as these innovative products gain traction, reflecting a dynamic response to evolving consumer preferences and health trends.

Government Initiatives and Regulations

Government initiatives aimed at improving public health are influencing the cough syrup market in India. Regulatory bodies are increasingly focusing on the safety and efficacy of pharmaceutical products, including cough syrups. This has led to stricter guidelines for manufacturing and marketing, ensuring that consumers receive high-quality products. Additionally, public health campaigns promoting awareness about respiratory health are likely to boost the demand for cough syrups. As a result, manufacturers are compelled to comply with these regulations, which may enhance consumer trust and drive sales in the cough syrup market. The ongoing support from the government could foster a more robust market environment.

Growing Awareness of Health and Wellness

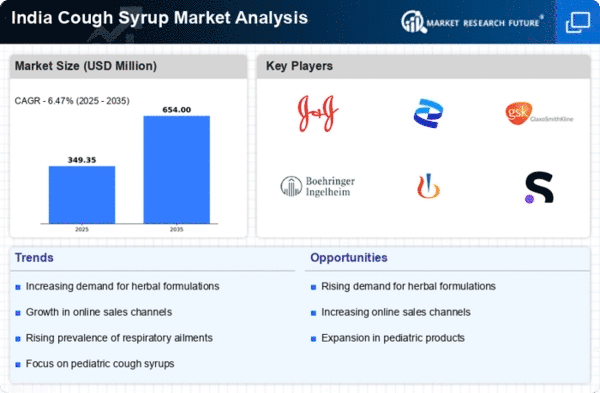

The increasing awareness of health and wellness among the Indian population is driving the cough syrup market. Consumers are becoming more conscious of their health choices, leading to a preference for products that are perceived as safe and effective. This trend is particularly evident among younger demographics, who are more likely to seek out cough syrups that contain natural ingredients or herbal formulations. As a result, manufacturers are responding by developing products that align with these preferences, which may contribute to a projected growth rate of approximately 8% in the cough syrup market over the next few years. This shift in consumer behavior indicates a potential for innovation and diversification within the cough syrup market.

Rising Incidence of Respiratory Disorders

The rise in respiratory disorders in India is significantly impacting the cough syrup market. Factors such as urban pollution, changing weather patterns, and lifestyle changes have led to an increase in conditions like asthma and bronchitis. According to health reports, respiratory diseases account for a substantial portion of healthcare burdens in the country. This has resulted in a higher demand for effective cough syrups, as patients seek relief from symptoms. the cough syrup market is expected to see a surge in sales as healthcare providers recommend these products as part of treatment regimens. This trend suggests a robust growth trajectory for the cough syrup market, driven by the need for effective therapeutic solutions.