Increasing Disposable Income

The rise in disposable income among the Indian population appears to be a significant driver for the cosmetic surgery market. As individuals experience improved financial stability, they are more inclined to invest in personal aesthetics. Reports indicate that the middle-class segment is expanding, with a notable increase in disposable income by approximately 10% annually. This financial empowerment enables more people to consider cosmetic procedures, which were previously deemed luxury services. The growing trend of self-care and personal enhancement is likely to further fuel demand in the cosmetic surgery market, as individuals seek to enhance their appearance and boost self-esteem.

Growing Influence of Social Media

The pervasive influence of social media platforms is reshaping perceptions of beauty and self-image, which appears to be a crucial driver for the cosmetic surgery market. With platforms like Instagram and Facebook showcasing idealized beauty standards, individuals are increasingly motivated to pursue cosmetic enhancements. Research suggests that nearly 70% of young adults in urban areas are influenced by social media trends when considering cosmetic procedures. This trend is likely to continue, as social media serves as a platform for sharing personal experiences and results, thereby normalizing cosmetic surgery and encouraging more individuals to explore these options.

Increased Awareness and Education

There is a growing awareness and education regarding cosmetic surgery options among the Indian populace, which seems to be positively impacting the market. Educational campaigns and increased access to information about procedures, risks, and benefits are empowering individuals to make informed decisions. Approximately 55% of potential patients report having researched cosmetic procedures before consulting a surgeon. This heightened awareness is likely to lead to increased inquiries and consultations, thereby driving growth in the cosmetic surgery market. As more individuals become educated about the possibilities and advancements in cosmetic surgery, the market is expected to expand further.

Advancements in Medical Technology

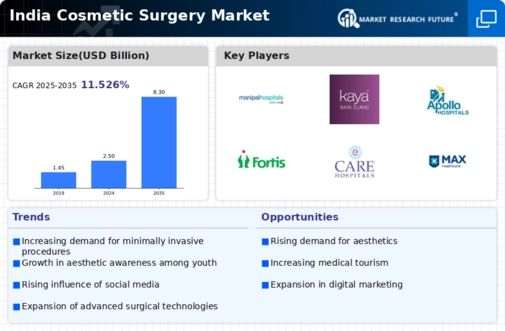

Technological innovations in the field of cosmetic surgery are transforming the landscape of the market in India. The introduction of advanced surgical techniques and minimally invasive procedures has made cosmetic surgeries safer and more accessible. For instance, the use of 3D imaging and robotic-assisted surgeries has improved precision and outcomes, attracting a broader clientele. The cosmetic surgery market is projected to grow at a CAGR of 15% over the next five years, driven by these advancements. As patients become more informed about the benefits of these technologies, the demand for cosmetic procedures is likely to increase, reflecting a shift towards more sophisticated surgical options.

Cultural Shifts Towards Beauty Standards

Cultural perceptions of beauty in India are evolving, which seems to be influencing the cosmetic surgery market. Traditional beauty standards are gradually being replaced by more diverse and modern ideals, leading to increased acceptance of cosmetic procedures. Surveys indicate that around 60% of urban Indians now view cosmetic surgery as a viable option for enhancing their appearance. This shift in mindset is likely to encourage more individuals to seek surgical enhancements, thereby expanding the market. The influence of Bollywood and celebrity culture also plays a role, as public figures openly discuss their cosmetic procedures, further normalizing the practice.