Supportive Government Policies

The continuous renal-replacement-therapy market is positively influenced by supportive government policies aimed at improving renal care in India. Initiatives such as the National Health Mission and various state-level programs focus on enhancing access to dialysis services and promoting awareness about kidney health. These policies often include financial assistance for patients, which can alleviate the cost burden associated with continuous renal-replacement-therapy. As the government continues to prioritize renal health, the market is expected to grow, with increased funding and resources allocated to improve treatment accessibility and quality across the country.

Increased Healthcare Expenditure

The continuous renal-replacement-therapy market benefits from rising healthcare expenditure in India. The government and private sectors are investing significantly in healthcare infrastructure, which includes the establishment of specialized renal care units. In recent years, healthcare spending has increased to approximately 3.5 % of GDP, reflecting a commitment to improving health services. This financial support enables hospitals to acquire advanced continuous renal-replacement-therapy equipment and train healthcare professionals, thereby enhancing the quality of care provided to patients. As a result, the market is likely to see sustained growth as more facilities become equipped to offer these essential therapies.

Advancements in Medical Technology

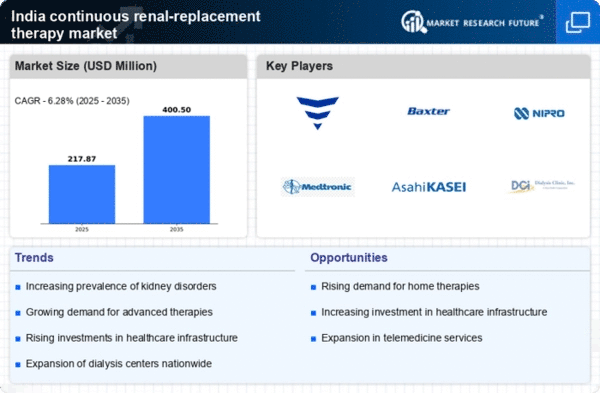

Technological innovations play a crucial role in shaping the continuous renal-replacement-therapy market. The introduction of advanced dialysis machines and monitoring systems has improved patient outcomes and operational efficiency in healthcare settings. For instance, the latest machines offer enhanced filtration capabilities and real-time monitoring, which are essential for managing critically ill patients. The market is projected to grow at a CAGR of around 8 % over the next few years, driven by these technological advancements. Furthermore, the integration of artificial intelligence and machine learning in treatment protocols is expected to optimize therapy delivery, making it more effective and personalized for patients.

Rising Incidence of Kidney Diseases

The continuous renal-replacement-therapy market is growing due to the increasing prevalence of kidney diseases in India. Chronic kidney disease (CKD) affects approximately 17 % of the adult population, leading to a heightened demand for renal replacement therapies. As the population ages and lifestyle-related health issues become more common, the number of patients requiring dialysis or renal replacement therapy is likely to rise. This trend is further exacerbated by the growing incidence of diabetes and hypertension, which are significant risk factors for kidney failure. Consequently, healthcare providers are increasingly adopting continuous renal-replacement-therapy solutions to manage these patients effectively, thereby driving market expansion.

Growing Demand for Home-Based Therapies

There is a noticeable shift towards home-based continuous renal-replacement-therapy solutions in India, driven by patient preferences for comfort and convenience. As awareness of home dialysis options increases, patients are more inclined to opt for therapies that allow them to manage their conditions from home. This trend is supported by advancements in portable dialysis equipment, which are designed to be user-friendly and efficient. The continuous renal-replacement-therapy market is likely to expand as healthcare providers adapt to this demand. They will offer training and support for patients and caregivers. This shift not only enhances patient satisfaction but also reduces the burden on healthcare facilities.