Emergence of Edge Computing

The emergence of edge computing is reshaping the containers as-a-service market in India. As more devices become interconnected, the need for processing data closer to the source is becoming increasingly apparent. Containers are well-suited for edge environments due to their lightweight nature and rapid deployment capabilities. This trend is particularly relevant for industries such as manufacturing and healthcare, where real-time data processing is critical. The integration of edge computing with container technology is expected to enhance operational efficiency and reduce latency. Analysts predict that the edge computing market could grow by over 30% in the coming years, further driving the demand for containers as-a-service solutions. This convergence of technologies is likely to create new opportunities within the containers as-a-service market.

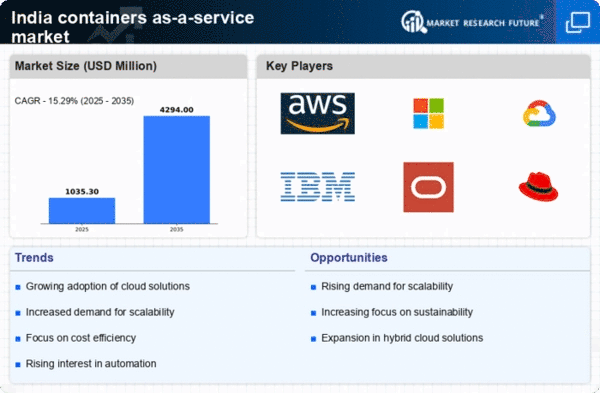

Growing Demand for Scalability

The containers as-a-service market in India is experiencing a notable surge in demand for scalability. As businesses increasingly seek to enhance their operational efficiency, the ability to scale applications seamlessly becomes paramount. This trend is particularly evident among startups and SMEs, which often require flexible solutions to accommodate fluctuating workloads. According to recent data, the scalability offered by containers can lead to a reduction in infrastructure costs by up to 30%. This capability allows organizations to respond swiftly to market changes, thereby fostering innovation and competitiveness. Consequently, the growing demand for scalable solutions is driving the containers as-a-service market, as companies recognize the need for adaptable infrastructure to support their evolving business models.

Increased Focus on Cost Efficiency

Cost efficiency remains a critical driver for the containers as-a-service market in India. Organizations are increasingly looking for ways to optimize their IT expenditures while maintaining high performance. Containers provide a lightweight alternative to traditional virtual machines, enabling businesses to run multiple applications on a single server, which can lead to significant savings. Reports indicate that companies utilizing container technology can achieve up to 40% savings in operational costs. This financial incentive is compelling for many enterprises, particularly in a competitive landscape where budget constraints are prevalent. As a result, the emphasis on cost efficiency is propelling the growth of the containers as-a-service market, as organizations seek to leverage this technology to enhance their bottom line.

Rise of Microservices Architecture

The adoption of microservices architecture is significantly influencing the containers as-a-service market in India. This architectural style allows organizations to develop and deploy applications as a collection of loosely coupled services, which can be independently managed and scaled. The containers facilitate this approach by providing an isolated environment for each microservice, enhancing deployment speed and reliability. As businesses increasingly transition to microservices, the demand for container solutions is expected to rise. Market Research Future suggest that the microservices trend could lead to a 50% increase in the adoption of container technologies over the next few years. This shift is indicative of a broader movement towards agile development practices, further driving the containers as-a-service market.

Growing Interest in DevOps Practices

The containers as-a-service market in India is being propelled by the growing interest in DevOps practices. Organizations are increasingly adopting DevOps to enhance collaboration between development and operations teams, thereby accelerating the software delivery process. Containers play a crucial role in this transformation by providing a consistent environment for development, testing, and production. This consistency reduces the likelihood of deployment issues, which can hinder productivity. As a result, companies that implement DevOps methodologies are likely to see a marked improvement in their operational efficiency. Data suggests that organizations embracing DevOps can achieve deployment frequency increases of up to 200%. This trend underscores the importance of containers in facilitating DevOps practices, thereby driving the containers as-a-service market.