Industrial Growth and Automation

The circuit breaker market in India is poised for growth due to the expansion of the industrial sector and the increasing trend towards automation. As industries modernize and adopt automated processes, the demand for reliable electrical protection systems rises. The manufacturing sector, which contributes approximately 16% to India's GDP, is particularly influential in driving this market. The implementation of Industry 4.0 technologies necessitates advanced circuit breakers that can support high-performance machinery and ensure operational safety. This trend is expected to propel the circuit breaker market forward, with a projected growth rate of 6% over the next few years, as industries prioritize safety and efficiency.

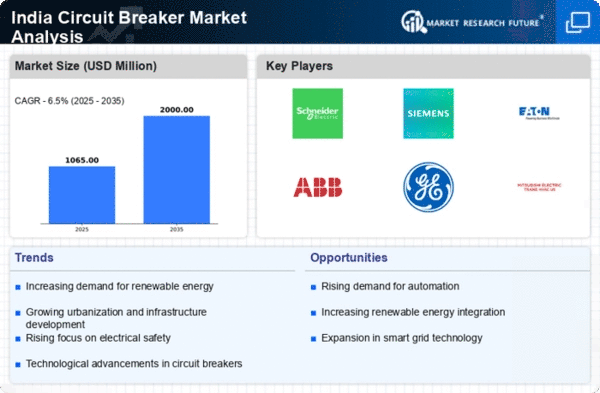

Rising Demand for Renewable Energy

The circuit breaker market in India is experiencing a notable surge in demand due to the increasing adoption of renewable energy sources. As the country aims to achieve its ambitious target of 500 GW of renewable energy capacity by 2030, the need for reliable circuit protection becomes paramount. This transition necessitates advanced circuit breakers that can handle the unique characteristics of renewable energy systems, such as solar and wind. The circuit breaker market is projected to grow at a CAGR of approximately 8% over the next five years, driven by this shift towards cleaner energy. Furthermore, the integration of smart grid technologies is likely to enhance the functionality of circuit breakers, making them essential components in modern energy systems.

Increased Focus on Safety Standards

The circuit breaker market is significantly influenced by the heightened focus on safety standards in India. Regulatory bodies are increasingly mandating compliance with stringent safety norms to protect both infrastructure and personnel. This regulatory environment compels manufacturers to innovate and produce circuit breakers that meet these evolving standards. The Bureau of Indian Standards (BIS) has introduced various guidelines that impact the design and functionality of circuit breakers. As a result, the market is likely to see a shift towards more advanced and reliable products, with an expected growth rate of 5% as companies invest in compliance and safety enhancements.

Urbanization and Infrastructure Development

India's rapid urbanization is significantly impacting the circuit breaker market. With over 600 million people expected to move to urban areas by 2031, the demand for robust electrical infrastructure is escalating. This urban expansion necessitates the installation of advanced electrical systems, including circuit breakers, to ensure safety and reliability. The government has initiated various infrastructure projects, such as the Smart Cities Mission, which aims to develop 100 smart cities across the country. This initiative is likely to drive the circuit breaker market, as modern electrical systems require sophisticated circuit protection solutions. The market is anticipated to witness a growth rate of around 7% annually, reflecting the increasing investments in urban infrastructure.

Technological Innovations in Circuit Breakers

Technological advancements are reshaping the circuit breaker market in India. Innovations such as digital circuit breakers and smart technology integration are becoming increasingly prevalent. These advancements not only enhance the performance and reliability of circuit breakers but also facilitate better monitoring and control of electrical systems. The introduction of IoT-enabled circuit breakers allows for real-time data analysis and predictive maintenance, which can significantly reduce downtime and operational costs. As industries and commercial establishments seek to optimize their electrical systems, the circuit breaker market is projected to grow at a rate of 7% annually, driven by these technological innovations.