Regulatory Support and Policy Frameworks

The Indian government is actively promoting policies that support the growth of the busbar systems market. Initiatives aimed at improving energy efficiency and reducing transmission losses are encouraging the adoption of advanced electrical distribution systems. Regulatory frameworks that incentivize the use of busbar systems in new construction projects are likely to boost market growth. Additionally, the government's commitment to enhancing the power sector's infrastructure is expected to create a conducive environment for the busbar systems market. With policies aimed at achieving 24x7 power supply, the market is set to expand as more projects incorporate these efficient systems.

Growing Urbanization and Infrastructure Needs

The rapid urbanization in India is driving the demand for efficient power distribution systems, including the busbar systems market. As cities expand, the need for reliable and high-capacity electrical distribution becomes paramount. Urban areas are witnessing a surge in construction activities, leading to increased electricity consumption. The busbar systems market is likely to benefit from this trend. These systems provide a compact and efficient solution for power distribution in high-rise buildings and commercial complexes. According to recent estimates, urban areas in India are expected to account for over 60% of the total electricity consumption by 2030, further emphasizing the importance of advanced busbar systems in meeting these demands.

Increased Focus on Renewable Energy Integration

The shift towards renewable energy sources in India is creating new opportunities for the busbar systems market. As the country aims to achieve 500 GW of renewable energy capacity by 2030, the integration of these energy sources into the existing grid becomes crucial. Busbar systems play a vital role in facilitating this integration by providing efficient and reliable connections between renewable energy sources and the grid. The growing emphasis on sustainability and reducing carbon footprints is likely to propel the demand for innovative busbar solutions that can accommodate fluctuating energy inputs from solar and wind sources.

Rising Industrialization and Manufacturing Growth

India's industrial sector is experiencing robust growth, which is significantly impacting the busbar systems market. The government's focus on 'Make in India' initiatives has led to increased investments in manufacturing and industrial infrastructure. Industries such as automotive, pharmaceuticals, and textiles are expanding, necessitating efficient power distribution systems. The busbar systems market is poised to grow as these industries require reliable and high-capacity electrical solutions to support their operations. It is estimated that the manufacturing sector could contribute up to 25% of India's GDP by 2025, thereby driving the demand for advanced busbar systems to ensure uninterrupted power supply.

Technological Advancements in Electrical Distribution

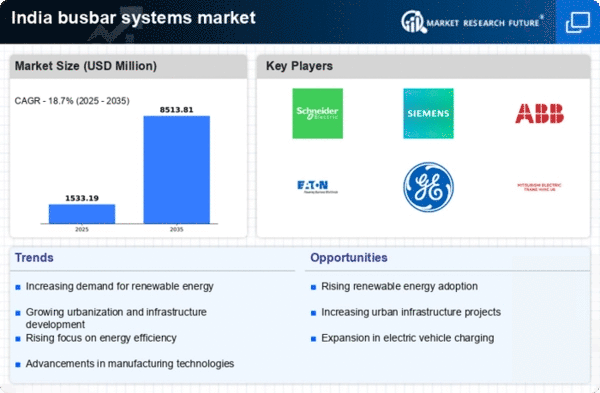

Technological innovations are transforming the landscape of the busbar systems market in India. The introduction of smart busbar systems, which incorporate advanced monitoring and control technologies, is enhancing the efficiency and reliability of power distribution. These systems allow for real-time data analysis and predictive maintenance, reducing downtime and operational costs. As industries and commercial establishments increasingly adopt automation and smart technologies, the demand for such advanced busbar systems is expected to rise. The market is likely to witness a CAGR of around 10% over the next five years, driven by these technological advancements.