Increasing Surgical Procedures

The rising number of surgical procedures in India is a key driver for the biosurgery market. As healthcare access improves, more patients are undergoing surgeries, which in turn increases the demand for biosurgical products. According to recent data, the surgical volume in India is projected to grow at a CAGR of approximately 8% over the next few years. This growth is attributed to factors such as an aging population, increased prevalence of chronic diseases, and advancements in surgical techniques. Consequently, the biosurgery market is likely to benefit from this trend, as surgeons increasingly rely on innovative biosurgical solutions to enhance patient outcomes and reduce recovery times.

Rising Incidence of Trauma Cases

The increasing incidence of trauma cases in India is a significant driver for the biosurgery market. With urbanization and changes in lifestyle, the number of road accidents and injuries is on the rise. This trend necessitates the use of biosurgical products for effective trauma management and surgical interventions. Data indicates that trauma-related surgeries are expected to increase by approximately 6% annually, creating a robust demand for biosurgical solutions. As healthcare providers seek to improve patient outcomes in trauma care, the biosurgery market is likely to see enhanced growth opportunities.

Investment in Healthcare Infrastructure

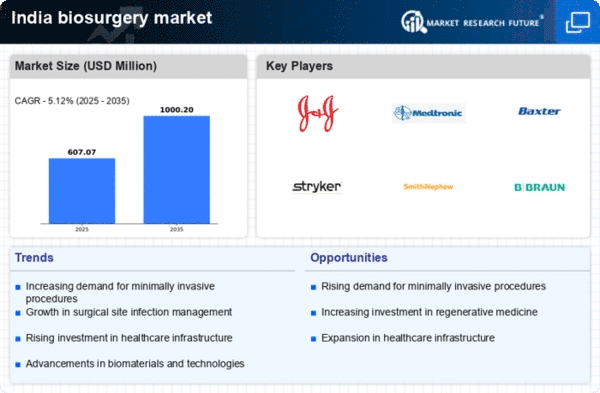

Investment in healthcare infrastructure in India is significantly impacting the biosurgery market. The government and private sector are channeling funds into the development of hospitals and surgical centers, which enhances the availability of advanced surgical services. This expansion is expected to increase the adoption of biosurgical products, as more facilities are equipped with the latest technologies. Reports suggest that healthcare expenditure in India is anticipated to reach $370 billion by 2025, which could lead to a corresponding rise in the utilization of biosurgical solutions. As infrastructure improves, the biosurgery market is poised for substantial growth.

Growing Awareness of Advanced Wound Care

There is a notable increase in awareness regarding advanced wound care solutions among healthcare professionals and patients in India. This awareness is driving the adoption of biosurgical products designed for effective wound management. The biosurgery market is experiencing a shift towards products that promote faster healing and reduce infection rates. Market data indicates that the advanced wound care segment is expected to grow by over 10% annually, reflecting a shift in treatment paradigms. As healthcare providers recognize the benefits of biosurgical interventions, the demand for these products is likely to rise, further propelling the growth of the biosurgery market.

Focus on Cost-Effective Healthcare Solutions

The emphasis on cost-effective healthcare solutions in India is shaping the biosurgery market. As healthcare costs continue to rise, both providers and patients are seeking affordable yet effective treatment options. Biosurgical products often offer advantages such as reduced hospital stays and lower complication rates, making them attractive alternatives. Market analysis suggests that the demand for cost-effective biosurgical solutions is likely to grow, as healthcare systems aim to optimize resource allocation. This focus on affordability may drive innovation and competition within the biosurgery market, ultimately benefiting patients and providers alike.