Rising Demand for Electric Vehicles

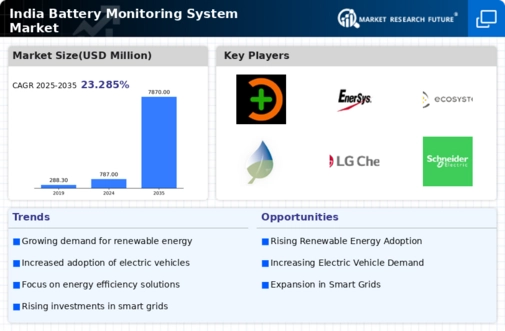

The increasing adoption of electric vehicles (EVs) in India is a pivotal driver for the battery monitoring-system market. As the government promotes EV usage through incentives and subsidies, the need for efficient battery management systems becomes paramount. The battery monitoring-system market is projected to grow at a CAGR of approximately 18.1% from 2025 to 2030, driven by the necessity for real-time monitoring and management of battery health in EVs. This trend not only enhances the performance and lifespan of batteries but also ensures safety, thereby attracting more consumers to the EV segment. Consequently, The market is likely to witness substantial growth as manufacturers seek to integrate advanced monitoring solutions into their EV offerings.

Government Initiatives and Policy Support

The Indian government is actively promoting initiatives aimed at enhancing battery technology and management systems. Policies such as the National Electric Mobility Mission Plan (NEMMP) and the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme are designed to support the growth of the battery monitoring-system market. These initiatives not only provide financial incentives but also create a conducive environment for research and development in battery technologies. As a result, the battery monitoring-system market is poised for growth, with increased investments from both public and private sectors. This policy support is likely to accelerate the adoption of advanced battery monitoring solutions across various industries.

Expansion of Renewable Energy Storage Solutions

The shift towards renewable energy sources in India, particularly solar and wind, necessitates robust energy storage solutions. The market is experiencing growth as energy storage systems become integral to managing the intermittent nature of renewable energy. With the Indian government targeting 175 GW of renewable energy capacity by 2022, the demand for efficient battery management systems is expected to rise. These systems play a crucial role in optimizing energy storage, ensuring that energy is available when needed. As a result, the battery monitoring-system market is likely to expand, driven by the increasing need for reliable energy storage solutions that can support the growing renewable energy infrastructure.

Growing Awareness of Battery Safety and Efficiency

As battery-related incidents gain media attention, there is a heightened awareness regarding battery safety and efficiency among consumers and industries in India. This awareness drives the demand for battery monitoring systems that can provide real-time data on battery health, temperature, and charge cycles. The market is expected to grow as businesses and consumers prioritize safety and efficiency in their battery usage. Regulatory bodies may also impose stricter safety standards, further propelling the adoption of monitoring systems. Consequently, the battery monitoring-system market is likely to expand as stakeholders seek to mitigate risks associated with battery failures and enhance overall operational efficiency.

Technological Advancements in Battery Technologies

Innovations in battery technologies, such as lithium-ion and solid-state batteries, are significantly influencing the battery monitoring-system market. As these technologies evolve, the complexity of battery management increases, necessitating advanced monitoring systems to ensure optimal performance and safety. The market is projected to benefit from these advancements, as manufacturers seek to implement sophisticated monitoring solutions that can handle the intricacies of new battery chemistries. This trend is particularly relevant in sectors such as consumer electronics and electric vehicles, where performance and reliability are critical. Therefore, the battery monitoring-system market is likely to see increased investment in research and development to keep pace with technological advancements.