Rising Geriatric Population

India's demographic shift towards an aging population is significantly influencing the anticoagulation market. With the geriatric population projected to reach 300 million by 2030, the prevalence of age-related cardiovascular diseases is expected to increase. Older adults are at a higher risk for conditions requiring anticoagulation therapy, such as stroke and deep vein thrombosis. This demographic trend suggests a potential increase in the demand for anticoagulants, as healthcare systems adapt to cater to the needs of this population. The market could see a growth rate of around 20% in the coming years, driven by the necessity for effective management of anticoagulation in elderly patients, thereby shaping the future landscape of the anticoagulation market.

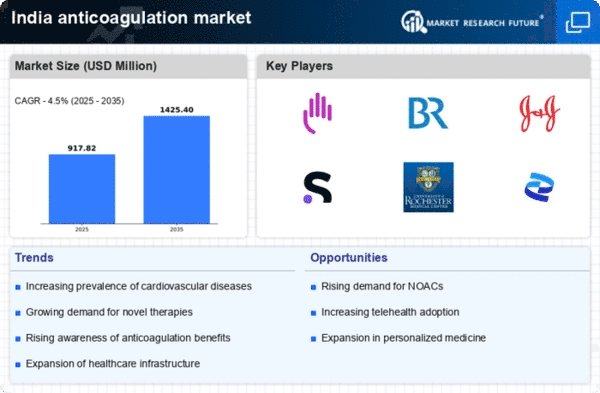

Expansion of Healthcare Infrastructure

The expansion of healthcare infrastructure in India is a crucial driver for the anticoagulation market. With the government's focus on improving healthcare access, the establishment of new hospitals and clinics is on the rise. This expansion is expected to enhance the availability of anticoagulation therapies, making them more accessible to patients across various regions. As healthcare facilities increase, the market is likely to witness a growth rate of approximately 10% annually. Additionally, the integration of anticoagulation management services within these facilities is anticipated to improve patient outcomes and adherence to therapy, further stimulating the anticoagulation market.

Technological Innovations in Drug Delivery

Technological innovations in drug delivery systems are transforming the anticoagulation market in India. Advances such as the development of novel oral anticoagulants and user-friendly delivery devices are enhancing patient compliance and treatment efficacy. These innovations are expected to drive market growth by approximately 12% over the next few years. Furthermore, the introduction of digital health solutions, including mobile applications for monitoring and managing anticoagulation therapy, is likely to empower patients and healthcare providers alike. As these technologies become more prevalent, they may significantly influence the adoption rates of anticoagulants, thereby shaping the future of the anticoagulation market.

Increasing Awareness of Anticoagulation Therapy

The growing awareness regarding the benefits of anticoagulation therapy is a pivotal driver for the anticoagulation market in India. Educational campaigns by healthcare professionals and organizations have led to a better understanding of conditions like atrial fibrillation and venous thromboembolism. This heightened awareness is reflected in the increasing number of patients seeking anticoagulation treatment, which has been estimated to rise by approximately 15% annually. As patients become more informed about the risks associated with untreated conditions, the demand for anticoagulants is likely to surge, thereby propelling the anticoagulation market forward. Furthermore, the emphasis on preventive healthcare is encouraging more individuals to consult healthcare providers, further driving the market's growth.

Government Policies Supporting Anticoagulation Access

Government policies aimed at improving access to anticoagulation therapies are playing a vital role in shaping the anticoagulation market in India. Initiatives such as subsidized medications and insurance coverage for anticoagulant treatments are making these therapies more affordable for patients. Recent policy changes have led to a 25% increase in the number of patients receiving anticoagulation therapy. Additionally, the government's commitment to enhancing healthcare services in rural areas is expected to further expand the market. As these policies continue to evolve, they are likely to create a more favorable environment for the growth of the anticoagulation market, ensuring that more patients receive the necessary care.