Rising Prevalence of ITP

The Global Immune Thrombocytopenia (ITP) Market Industry is experiencing growth due to the increasing prevalence of ITP worldwide. Current estimates suggest that the incidence of ITP ranges from 1 to 6 cases per 100,000 people annually. This rise in cases necessitates enhanced diagnostic and therapeutic options, contributing to market expansion. As awareness of the disease grows, more patients are being diagnosed and treated, which is expected to drive the market's value to approximately 3.59 USD Billion in 2024. Consequently, the demand for innovative treatments and management strategies is likely to increase, further propelling the market forward.

Market Trends and Projections

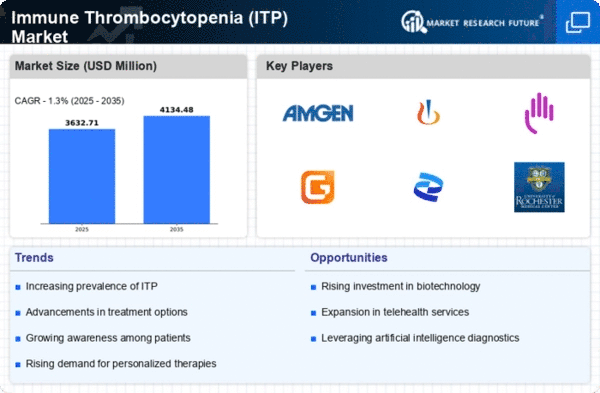

The Global Immune Thrombocytopenia (ITP) Market Industry is characterized by various trends that shape its trajectory. The market is projected to grow from an estimated 3.59 USD Billion in 2024 to approximately 4.13 USD Billion by 2035, reflecting a compound annual growth rate of 1.29% from 2025 to 2035. This growth is influenced by factors such as rising prevalence, advancements in treatment options, and increased awareness. The evolving landscape of ITP management indicates a dynamic market environment, where ongoing research and development efforts will likely play a crucial role in shaping future trends.

Supportive Government Policies

Government initiatives and policies aimed at improving healthcare access and affordability are positively impacting the Global Immune Thrombocytopenia (ITP) Market Industry. Various countries are implementing programs to subsidize treatment costs and enhance patient access to innovative therapies. For instance, reimbursement policies for ITP treatments are evolving, making them more accessible to patients. This supportive environment encourages pharmaceutical companies to invest in research and development, thereby expanding the market. As a result, the market is poised for growth, with projections indicating a steady increase in value as more patients benefit from these initiatives.

Advancements in Treatment Options

Innovations in treatment modalities are significantly influencing the Global Immune Thrombocytopenia (ITP) Market Industry. The introduction of novel therapies, including monoclonal antibodies and thrombopoietin receptor agonists, has transformed patient management. These advancements not only improve patient outcomes but also expand the therapeutic landscape, catering to diverse patient needs. As a result, the market is projected to grow steadily, reaching an estimated value of 4.13 USD Billion by 2035. The ongoing research and development efforts in this field indicate a promising future for treatment options, which may further enhance patient adherence and satisfaction.

Increased Awareness and Diagnosis

The Global Immune Thrombocytopenia (ITP) Market Industry is benefiting from heightened awareness and improved diagnostic capabilities. Educational initiatives aimed at healthcare professionals and the public have led to earlier detection and better management of ITP. Enhanced diagnostic technologies, such as advanced blood tests and imaging techniques, facilitate accurate diagnosis, which is crucial for effective treatment. This trend is expected to contribute to market growth, as more patients are identified and treated. The cumulative effect of these factors is likely to sustain a compound annual growth rate of 1.29% from 2025 to 2035, reflecting the market's resilience and adaptability.

Emerging Markets and Global Expansion

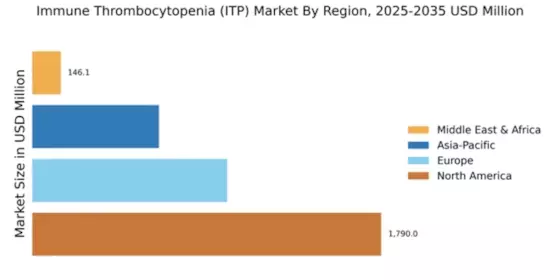

The Global Immune Thrombocytopenia (ITP) Market Industry is witnessing growth in emerging markets, where healthcare infrastructure is improving. Countries in Asia-Pacific and Latin America are increasingly recognizing the need for effective ITP management, leading to an uptick in treatment availability. As healthcare systems evolve, the demand for ITP therapies is expected to rise, contributing to the overall market expansion. The global reach of pharmaceutical companies is facilitating access to innovative treatments in these regions, which may further enhance market dynamics. This trend underscores the potential for significant growth in the coming years.