Demographic Shifts

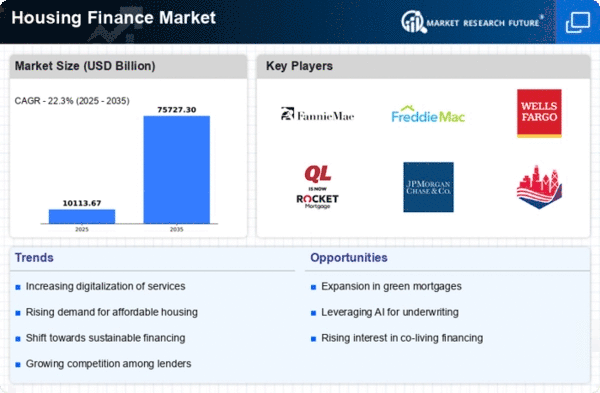

Demographic shifts are influencing the Global Housing Finance Market Industry, as changing population dynamics create new housing demands. The rise of millennials and Generation Z as homebuyers is altering the landscape of housing finance. These younger generations prioritize sustainability and affordability, prompting lenders to adapt their offerings accordingly. As a result, financial products are evolving to meet the preferences of these demographics. The market's value in 2024 stands at approximately 8269.6 USD Billion, with expectations of substantial growth as these demographic trends continue to unfold. Understanding these shifts is crucial for stakeholders aiming to capitalize on emerging opportunities.

Rising Urbanization

The Global Housing Finance Market Industry is experiencing a notable surge due to increasing urbanization. As more individuals migrate to urban areas in search of better employment opportunities and living standards, the demand for housing finance escalates. In 2024, the market is valued at approximately 8269.6 USD Billion, reflecting the urgent need for accessible financing options. Urban centers are expanding rapidly, leading to a higher requirement for residential properties. This trend is expected to continue, with projections indicating that by 2035, the market could reach 74496.2 USD Billion. Consequently, financial institutions are adapting their offerings to cater to this growing urban population.

Government Initiatives

Government initiatives play a pivotal role in driving the Global Housing Finance Market Industry. Various countries are implementing policies aimed at promoting affordable housing and improving access to financing. For instance, subsidies, tax incentives, and low-interest loans are being offered to first-time homebuyers. Such measures are designed to stimulate demand in the housing sector, thereby fostering economic growth. As these initiatives gain traction, they are expected to contribute significantly to the market's expansion. By 2035, the market could potentially reach 74496.2 USD Billion, underscoring the importance of government support in shaping housing finance dynamics.

Technological Advancements

Technological innovations are reshaping the Global Housing Finance Market Industry, enhancing the efficiency and accessibility of housing finance solutions. Digital platforms and mobile applications facilitate streamlined loan applications and approvals, making it easier for consumers to secure financing. The integration of artificial intelligence and big data analytics allows lenders to assess creditworthiness more accurately, thereby reducing risks. As a result, the market is likely to witness significant growth, with a projected CAGR of 22.12% from 2025 to 2035. This technological evolution not only benefits lenders but also empowers borrowers with better financial products tailored to their needs.

Increased Investment in Real Estate

The Global Housing Finance Market Industry is benefiting from increased investment in real estate, driven by both domestic and foreign investors. As property values rise, investors are seeking financing options to capitalize on lucrative opportunities. This influx of capital is stimulating demand for housing finance products, leading to a more competitive market landscape. The anticipated growth trajectory suggests that the market could achieve a CAGR of 22.12% from 2025 to 2035. This trend indicates a robust interest in real estate as a viable investment, further propelling the housing finance sector.