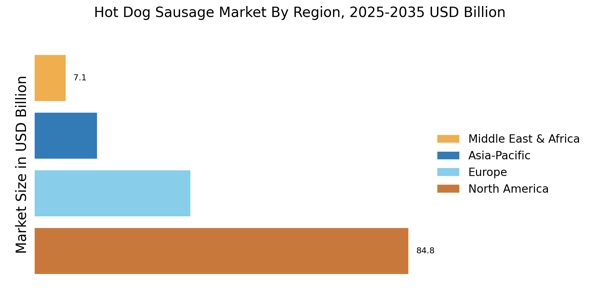

North America : Market Leader in Consumption

North America remains the largest market for hot dog sausages, accounting for approximately 60% of global consumption. The region's growth is driven by a strong demand for convenience foods, increasing outdoor activities, and a culture that embraces grilling and barbecuing. Regulatory support for food safety and quality standards further enhances market stability, encouraging innovation in product offerings. The United States is the primary player in this market, with key brands like Oscar Mayer, Nathan's Famous, and Hebrew National leading the charge. The competitive landscape is characterized by a mix of established brands and emerging players, all vying for consumer attention. The presence of large retail chains and food service establishments also bolsters market growth, ensuring a steady supply of hot dog products across various channels.

Europe : Growing Demand for Quality

Europe is witnessing a significant rise in the hot dog sausage market, holding approximately 25% of the global share. The growth is fueled by changing consumer preferences towards high-quality, organic, and gourmet products. Additionally, regulatory frameworks in the EU promote food safety and labeling transparency, which are crucial for consumer trust and market expansion. Leading countries in this region include Germany, France, and the UK, where traditional and innovative hot dog varieties are gaining popularity. The competitive landscape features both local artisans and international brands, creating a diverse market. Key players are adapting to trends by offering plant-based options and premium ingredients, catering to health-conscious consumers.

Asia-Pacific : Emerging Market Potential

The Asia-Pacific region is rapidly emerging as a significant player in the hot dog sausage market, currently holding about 10% of the global share. Factors driving this growth include urbanization, changing dietary habits, and a growing middle class with increased disposable income. Regulatory bodies are also beginning to implement food safety standards, which will further enhance market growth and consumer confidence. Countries like Japan, Australia, and China are leading the charge, with a growing interest in Western-style fast foods. The competitive landscape is evolving, with both local and international brands entering the market. Key players are focusing on product innovation and marketing strategies to appeal to younger consumers, who are increasingly seeking convenience and variety in their food choices.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa region is currently the smallest market for hot dog sausages, accounting for about 5% of global consumption. However, there is significant potential for growth driven by urbanization, changing lifestyles, and an increasing interest in Western cuisine. Regulatory frameworks are gradually improving, which will support market development and enhance food safety standards. Countries like South Africa and the UAE are at the forefront of this market, with a growing number of food service establishments offering hot dogs. The competitive landscape is characterized by a mix of local and international brands, with opportunities for innovation in flavors and product offerings. As consumer preferences evolve, there is a rising demand for diverse and convenient food options, paving the way for market expansion.