Innovations in Pharmaceutical Treatments

Innovations in pharmaceutical treatments for growth hormone deficiency are transforming the Growth Hormone Deficiency Market. Recent advancements in recombinant DNA technology have led to the development of more effective and safer growth hormone therapies. These innovations not only enhance treatment efficacy but also improve patient compliance due to reduced side effects. The market has seen the introduction of long-acting growth hormone formulations, which could potentially reduce the frequency of injections required. As these novel therapies gain regulatory approval and enter the market, they are expected to significantly boost the growth hormone deficiency treatment landscape, attracting both healthcare providers and patients.

Aging Population and Associated Health Issues

The aging population presents a significant driver for the Growth Hormone Deficiency Market. As individuals age, the natural decline in growth hormone levels can lead to various health issues, including decreased muscle mass, increased body fat, and diminished quality of life. This demographic shift is likely to increase the demand for growth hormone therapies aimed at mitigating these age-related conditions. Furthermore, the growing awareness of the benefits of hormone replacement therapy among older adults may lead to a surge in treatment adoption. Consequently, the aging population is expected to play a crucial role in shaping the future landscape of the growth hormone deficiency market.

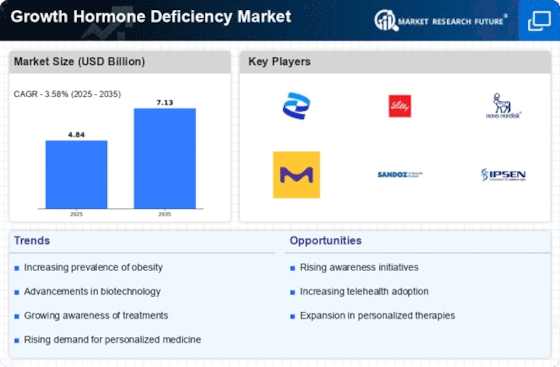

Rising Prevalence of Growth Hormone Deficiency

The increasing prevalence of growth hormone deficiency is a pivotal driver for the Growth Hormone Deficiency Market. Studies indicate that the incidence of this condition is on the rise, particularly among children and adults. It is estimated that approximately 1 in 3,000 children are affected by growth hormone deficiency, leading to significant demand for diagnostic and therapeutic solutions. As awareness grows, more individuals are being diagnosed, which in turn fuels the market for growth hormone therapies. This trend is likely to continue, as healthcare providers increasingly recognize the symptoms and implications of untreated growth hormone deficiency, thereby expanding the patient population that requires intervention.

Integration of Personalized Medicine Approaches

The integration of personalized medicine approaches is emerging as a transformative driver in the Growth Hormone Deficiency Market. Tailoring treatment plans based on individual patient profiles, including genetic and hormonal assessments, is becoming increasingly feasible. This shift towards personalized medicine not only enhances treatment efficacy but also minimizes adverse effects, thereby improving patient satisfaction. As healthcare providers adopt these approaches, the market for growth hormone therapies is likely to expand, as patients seek customized solutions that align with their specific health needs. This trend may also encourage pharmaceutical companies to develop targeted therapies that cater to diverse patient populations.

Increased Investment in Research and Development

Increased investment in research and development is propelling the Growth Hormone Deficiency Market forward. Pharmaceutical companies are allocating substantial resources to explore new treatment modalities and improve existing therapies. This trend is evidenced by the growing number of clinical trials focused on growth hormone deficiency, which have surged in recent years. The financial commitment to R&D not only fosters innovation but also enhances the understanding of the underlying mechanisms of growth hormone deficiency. As new findings emerge, they may lead to the development of targeted therapies that could revolutionize treatment approaches, thereby expanding market opportunities.