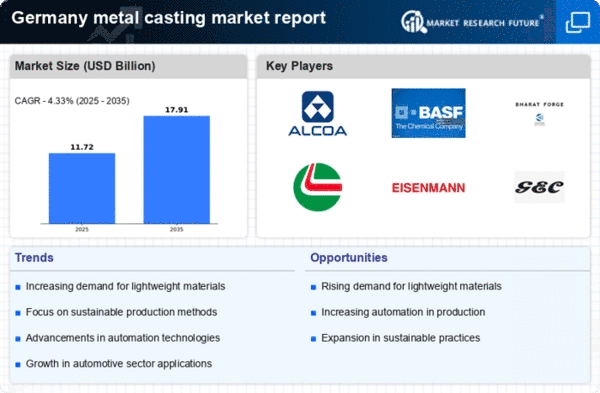

The metal casting market in Germany exhibits a dynamic competitive landscape, characterized by a blend of established players and emerging innovators. Key growth drivers include the increasing demand for lightweight materials in automotive and aerospace applications, alongside a push for sustainable manufacturing practices. Major companies such as Thyssenkrupp AG (DE), Alcoa Corporation (US), and BASF SE (DE) are strategically positioned to leverage these trends. Thyssenkrupp AG (DE) focuses on digital transformation and automation in its casting processes, enhancing efficiency and reducing waste. Alcoa Corporation (US) emphasizes innovation in aluminum casting technologies, while BASF SE (DE) is investing in sustainable materials and processes, collectively shaping a competitive environment that prioritizes technological advancement and environmental responsibility.The business tactics employed by these companies reflect a concerted effort to optimize operations and enhance market presence. Localizing manufacturing to reduce lead times and costs is a common strategy, alongside supply chain optimization to ensure resilience against disruptions. The market structure appears moderately fragmented, with a mix of large corporations and smaller specialized firms. The collective influence of key players fosters a competitive atmosphere where innovation and operational excellence are paramount.

In October Thyssenkrupp AG (DE) announced a partnership with a leading technology firm to develop AI-driven solutions for predictive maintenance in casting operations. This strategic move is likely to enhance operational efficiency and reduce downtime, positioning Thyssenkrupp as a frontrunner in the integration of advanced technologies within the metal casting sector. Such initiatives not only improve productivity but also align with the growing trend towards digitalization in manufacturing.

In September Alcoa Corporation (US) unveiled a new line of sustainable aluminum castings aimed at the automotive industry. This initiative underscores Alcoa's commitment to sustainability and innovation, as it seeks to meet the increasing demand for eco-friendly materials. The introduction of these products is expected to strengthen Alcoa's market position and appeal to environmentally conscious consumers and manufacturers alike.

In August BASF SE (DE) launched a new range of bio-based casting materials, further solidifying its role as a leader in sustainable practices within the metal casting market. This development not only enhances BASF's product portfolio but also reflects a broader industry trend towards sustainability. The adoption of bio-based materials may attract a new customer base focused on reducing their carbon footprint, thereby expanding BASF's market reach.

As of November current competitive trends in the metal casting market are increasingly defined by digitalization, sustainability, and the integration of AI technologies. Strategic alliances among key players are shaping the landscape, fostering innovation and collaboration. The shift from price-based competition to a focus on technological differentiation and supply chain reliability is evident. Companies that prioritize innovation and sustainable practices are likely to gain a competitive edge, suggesting that the future of the market will hinge on the ability to adapt to evolving consumer preferences and regulatory demands.