Rising Demand for Automation

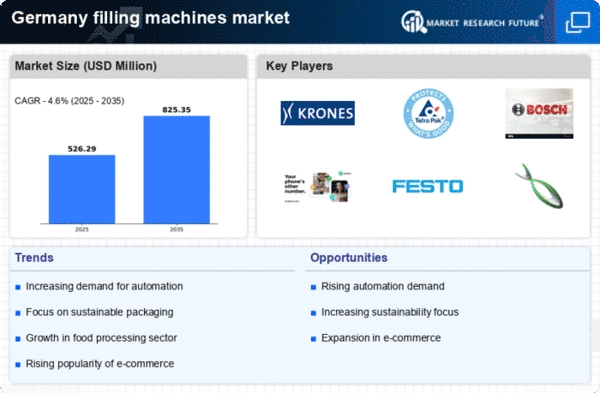

The filling machines market in Germany experiences a notable surge in demand for automation technologies. Industries are increasingly adopting automated filling solutions to enhance efficiency and reduce labor costs. This trend is driven by the need for higher production rates and improved accuracy in filling processes. According to recent data, the automation segment within the filling machines market is projected to grow at a CAGR of approximately 8% over the next five years. As manufacturers seek to optimize their operations, the integration of advanced robotics and control systems becomes essential. This shift not only streamlines production but also minimizes human error, thereby ensuring product quality. Consequently, the filling machines market is likely to witness significant investments in automation technologies, positioning it for robust growth in the coming years.

Emergence of Smart Packaging Solutions

The filling machines market in Germany is witnessing a transformative shift. This change is driven by the emergence of smart packaging solutions. These innovations integrate technology into packaging processes, allowing for enhanced tracking, monitoring, and consumer engagement. Smart packaging, which includes features such as QR codes and RFID tags, is gaining traction as companies seek to provide added value to consumers. This trend is particularly relevant in sectors like food and beverage, where transparency and traceability are increasingly demanded. The integration of smart technologies into filling machines enables manufacturers to optimize their operations and improve supply chain efficiency. As consumer preferences evolve, the filling machines market is likely to adapt by incorporating smart packaging capabilities, thereby enhancing the overall value proposition of products.

Growth in E-commerce and Online Retail

The filling machines market in Germany is significantly influenced by the rapid expansion of e-commerce. The online retail sectors are also contributing to this growth. As consumer preferences shift towards online shopping, manufacturers are compelled to adapt their packaging and filling processes to meet the demands of this evolving landscape. The e-commerce sector has seen a remarkable increase, with online sales accounting for over 15% of total retail sales in Germany. This growth necessitates efficient filling solutions that can handle diverse product types and packaging formats. Companies are increasingly investing in flexible filling machines that can accommodate various container sizes and materials. This adaptability is crucial for meeting the fast-paced requirements of e-commerce fulfillment centers. As a result, the filling machines market is poised for growth, driven by the need for innovative solutions that cater to the dynamic nature of online retail.

Regulatory Compliance and Quality Standards

The filling machines market in Germany is heavily influenced by stringent regulatory compliance. Quality standards imposed by governmental bodies also play a significant role. Industries such as food and beverage, pharmaceuticals, and cosmetics are required to adhere to rigorous safety and quality regulations. This necessitates the adoption of advanced filling technologies that ensure compliance with these standards. For instance, the implementation of Good Manufacturing Practices (GMP) is critical in the pharmaceutical sector, where precision and hygiene are paramount. As a result, manufacturers are increasingly investing in filling machines that incorporate features such as automated cleaning systems and real-time monitoring capabilities. This focus on compliance not only enhances product safety but also boosts consumer confidence. Consequently, the filling machines market is likely to see sustained growth as companies prioritize adherence to regulatory requirements.

Focus on Cost Efficiency and Resource Optimization

The filling machines market in Germany is increasingly characterized by a focus on cost efficiency. Resource optimization is also a key factor. Manufacturers are under constant pressure to reduce operational costs while maintaining high-quality standards. This has led to the adoption of filling machines that are designed for energy efficiency and minimal waste generation. Recent studies indicate that companies that implement resource optimization strategies can achieve cost savings of up to 20%. As a result, there is a growing demand for filling machines that utilize advanced technologies, such as energy-efficient motors and recyclable materials. This trend not only contributes to lower production costs but also aligns with broader sustainability goals. Consequently, the filling machines market is likely to experience growth as companies prioritize cost-effective solutions that enhance their competitive edge.