Regulatory Support and Frameworks

The regulatory environment in Germany is evolving to support the growth of the cell line development market. The Federal Institute for Drugs and Medical Devices (BfArM) and the European Medicines Agency (EMA) are continuously updating guidelines to streamline the approval processes for biopharmaceuticals. This regulatory support is crucial as it encourages companies to invest in cell line development, knowing that there is a clear pathway for bringing products to market. In 2025, it is anticipated that the regulatory framework will become even more conducive, potentially reducing approval times by up to 20%. Such improvements are likely to enhance the attractiveness of the cell line-development market for both domestic and international players, fostering a more robust ecosystem for biopharmaceutical innovation.

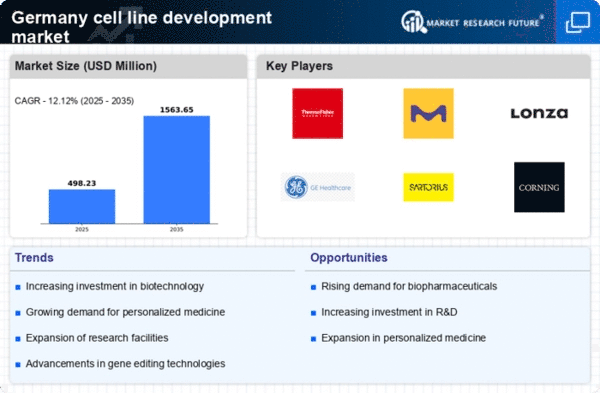

Increasing Investment in Biotechnology

Germany's cell line development market is benefiting from a notable increase in investment in the biotechnology sector. The German government has been actively promoting biotechnology through funding initiatives and grants, which has led to a rise in research and development activities. In 2025, the biotechnology sector in Germany is expected to receive over €1 billion in public and private investments, significantly impacting the cell line-development market. This influx of capital is likely to facilitate the establishment of new laboratories and research facilities, enhancing the capacity for cell line development. Additionally, collaborations between academic institutions and industry players are becoming more prevalent, fostering innovation and accelerating the development of novel cell lines. Such investments are crucial for meeting the growing demand for biopharmaceuticals and personalized medicine, thereby driving the cell line-development market forward.

Growing Demand for Personalized Medicine

The shift towards personalized medicine is significantly influencing the cell line development market in Germany. As healthcare moves towards more tailored treatment options, the need for specific cell lines that can mimic patient responses is becoming increasingly critical. This trend is expected to drive the market, with projections indicating a growth rate of around 15% annually through 2026. Companies are focusing on developing cell lines that can be used for patient-specific drug testing and therapy development. This demand is not only reshaping the types of cell lines being developed but also encouraging collaborations between research institutions and pharmaceutical companies. The emphasis on personalized medicine is likely to create new opportunities within the cell line-development market, as stakeholders seek to innovate and meet the unique needs of patients.

Expansion of Research and Development Facilities

The expansion of research and development facilities in Germany is a key driver for the cell line development market. Numerous biotechnology firms are establishing or upgrading their R&D centers to enhance their capabilities in cell line development. In 2025, it is estimated that the number of dedicated R&D facilities will increase by approximately 30%, reflecting the growing interest in biopharmaceutical research. This expansion is expected to facilitate more comprehensive studies and faster development cycles for new cell lines. Additionally, the establishment of specialized centers focused on cell line characterization and validation is likely to improve the quality and reliability of cell lines produced. Such developments are essential for meeting the increasing demands of the biopharmaceutical industry, thereby propelling the growth of the cell line-development market.

Technological Advancements in Cell Line Development

The cell line development market in Germany is experiencing a surge due to rapid technological advancements. Innovations in gene editing techniques, such as CRISPR-Cas9, are enhancing the efficiency and precision of cell line creation. This is particularly relevant as the market is projected to reach approximately €1.5 billion by 2026, driven by the need for high-quality cell lines in drug development and research. Furthermore, automation and high-throughput screening technologies are streamlining workflows, reducing time and costs associated with cell line development. As a result, companies are increasingly investing in these technologies to maintain a competitive edge in the cell line-development market. The integration of artificial intelligence in data analysis is also expected to play a crucial role in optimizing cell line selection and characterization, thereby further propelling market growth.