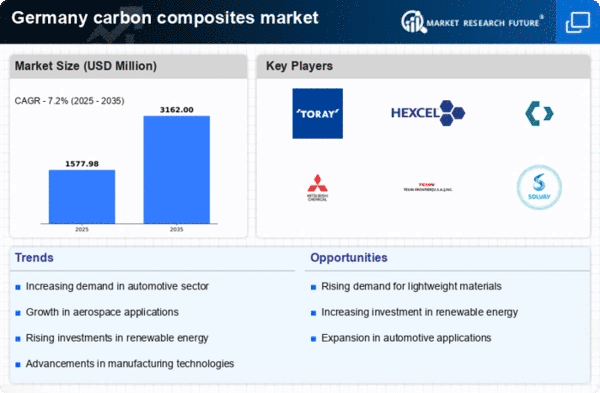

The carbon composites market in Germany is characterized by a dynamic competitive landscape, driven by increasing demand across various sectors such as aerospace, automotive, and renewable energy. Key players are actively pursuing strategies that emphasize innovation, sustainability, and regional expansion. For instance, Toray Industries (Japan) has positioned itself as a leader in advanced materials, focusing on R&D to enhance product performance and reduce environmental impact. Similarly, SGL Carbon (Germany) is leveraging its expertise in carbon fiber technology to cater to the growing needs of the automotive industry, particularly in lightweight applications. These strategic orientations collectively shape a competitive environment that is increasingly focused on technological advancement and sustainability.In terms of business tactics, companies are localizing manufacturing to enhance supply chain efficiency and reduce lead times. This approach is particularly relevant in a moderately fragmented market where collaboration among key players can lead to improved operational synergies. The competitive structure is influenced by the presence of both established firms and emerging players, each contributing to a diverse ecosystem that fosters innovation and responsiveness to market demands.

In October Hexcel Corporation (US) announced a strategic partnership with a leading aerospace manufacturer to develop next-generation composite materials aimed at reducing weight and improving fuel efficiency in aircraft. This collaboration underscores Hexcel's commitment to innovation and positions it favorably within the aerospace sector, where performance and sustainability are paramount. The partnership is expected to enhance Hexcel's market share and reinforce its reputation as a pioneer in composite technology.

In September Mitsubishi Chemical (Japan) unveiled a new production facility in Germany dedicated to the manufacturing of carbon fiber reinforced plastics (CFRP). This investment reflects the company's strategy to expand its footprint in Europe and meet the rising demand for lightweight materials in the automotive and aerospace industries. The facility is anticipated to bolster Mitsubishi's production capabilities and enhance its competitive edge in the region.

In August Solvay (Belgium) launched a new line of sustainable carbon composites designed for use in the automotive sector. This initiative aligns with the growing trend towards eco-friendly materials and positions Solvay as a forward-thinking player in the market. The introduction of these products is likely to attract environmentally conscious manufacturers and could lead to increased market penetration for Solvay.

As of November the competitive trends in the carbon composites market are increasingly defined by digitalization, sustainability, and the integration of advanced technologies such as AI. Strategic alliances are becoming more prevalent, enabling companies to pool resources and expertise to drive innovation. The shift from price-based competition to a focus on technological differentiation and supply chain reliability is evident, suggesting that future competitive dynamics will hinge on the ability to innovate and adapt to evolving market needs.