Government Initiatives and Support Programs

Government initiatives aimed at reducing tobacco use significantly influence the smokeless tobacco-treatment market. In the GCC, various health ministries have launched campaigns to promote cessation and provide support for individuals seeking to quit smokeless tobacco. These initiatives often include funding for treatment programs, public awareness campaigns, and the establishment of quitlines. For instance, a recent initiative in the UAE allocated $5 million to support cessation programs, which is expected to enhance the accessibility of treatment options. Such government backing not only raises awareness but also encourages individuals to seek help, thereby expanding the smokeless tobacco-treatment market. The collaboration between public health authorities and private sector stakeholders further strengthens the infrastructure necessary for effective treatment delivery.

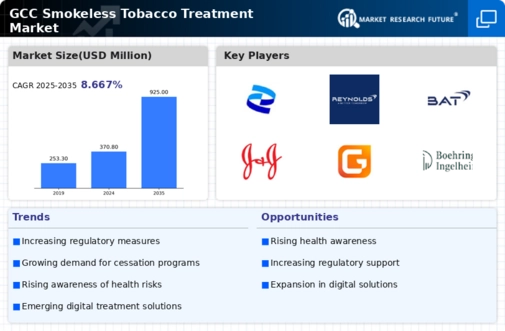

Increasing Prevalence of Smokeless Tobacco Use

The rising prevalence of smokeless tobacco use in the GCC region is a critical driver for the smokeless tobacco-treatment market. Recent studies indicate that approximately 10% of the adult population in certain GCC countries engages in smokeless tobacco consumption. This trend necessitates effective treatment options, as the health risks associated with smokeless tobacco are well-documented. The increasing number of users creates a larger market for cessation products and services, thereby driving growth in the smokeless tobacco-treatment market. Furthermore, the cultural acceptance of smokeless tobacco in some areas may lead to a greater demand for tailored treatment solutions that address the unique needs of this demographic. As awareness of the health implications continues to grow, the market is likely to expand to accommodate the needs of these users.

Growing Demand for Customized Treatment Options

The smokeless tobacco-treatment market is witnessing a growing demand for customized treatment options tailored to individual needs. As awareness of the diverse effects of smokeless tobacco increases, users are seeking personalized solutions that address their specific circumstances. This trend is particularly evident in the GCC, where cultural and social factors influence tobacco use patterns. Treatment programs that incorporate behavioral therapy, counseling, and pharmacotherapy are gaining traction, as they offer a more holistic approach to cessation. Market data suggests that customized treatment options can improve quit rates by up to 25%, indicating their effectiveness. Consequently, the smokeless tobacco-treatment market is likely to expand as providers develop and promote tailored solutions that resonate with users, ultimately enhancing treatment outcomes.

Technological Advancements in Treatment Solutions

Technological advancements play a pivotal role in shaping the smokeless tobacco-treatment market. Innovations in digital health, such as mobile applications and telehealth services, have emerged as effective tools for supporting individuals in their cessation journey. These technologies provide personalized treatment plans, real-time tracking of progress, and access to professional guidance. In the GCC, the adoption of such technologies is on the rise, with a reported increase of 30% in the use of digital health solutions for tobacco cessation in the past year. This trend suggests that the smokeless tobacco-treatment market is evolving to meet the needs of a tech-savvy population, potentially leading to higher success rates in quitting. As these technologies continue to develop, they may further enhance the effectiveness and reach of treatment options available.

Rising Economic Burden of Tobacco-Related Health Issues

The economic burden associated with tobacco-related health issues is a significant driver for the smokeless tobacco-treatment market. In the GCC, healthcare costs related to tobacco use are escalating, with estimates suggesting that they could reach $1 billion annually by 2026 if current trends continue. This financial strain on healthcare systems prompts governments and health organizations to prioritize tobacco cessation efforts. As a result, there is an increasing investment in treatment programs aimed at reducing the prevalence of smokeless tobacco use. The potential for cost savings through improved public health outcomes creates a compelling case for expanding the smokeless tobacco-treatment market. By addressing the economic implications of tobacco use, stakeholders are likely to foster a more proactive approach to cessation, ultimately benefiting both individuals and society.