Rising Demand for Efficiency

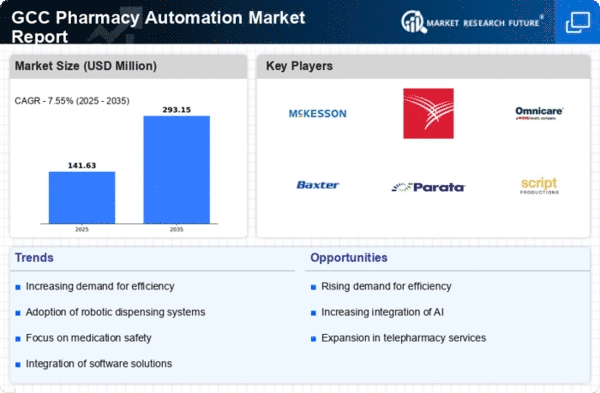

The pharmacy automation market is experiencing a notable surge in demand for efficiency within healthcare settings. As healthcare providers strive to optimize operations, automation technologies are increasingly viewed as essential tools. In the GCC region, the market is projected to grow at a CAGR of approximately 10% from 2025 to 2030. This growth is driven by the need to reduce medication errors and streamline workflows, which can lead to improved patient outcomes. Automation solutions, such as robotic dispensing systems and automated inventory management, are becoming integral to pharmacy operations. The emphasis on efficiency not only enhances service delivery but also allows pharmacists to focus more on patient care, thereby transforming the role of pharmacy professionals in the healthcare ecosystem.

Growing Focus on Patient Safety

Patient safety remains a paramount concern in the pharmacy automation market. With increasing awareness of medication errors and their consequences, healthcare providers are prioritizing solutions that enhance safety protocols. In the GCC, the implementation of automated systems is projected to reduce medication errors by as much as 50% within the next few years. This focus on safety is prompting pharmacies to invest in automation technologies that provide real-time tracking and verification of medications. As regulatory bodies emphasize the importance of patient safety, the pharmacy automation market is likely to see a corresponding rise in demand for systems that ensure compliance with safety standards and improve overall patient care.

Economic Incentives for Automation

Economic incentives are playing a crucial role in the growth of the pharmacy automation market. Governments in the GCC are increasingly recognizing the cost-saving potential of automation technologies in healthcare. By reducing labor costs and minimizing medication errors, automated systems can lead to substantial financial savings for pharmacies. Reports indicate that pharmacies adopting automation can save up to $100,000 annually through improved efficiency and reduced waste. As economic pressures mount, the push for automation is likely to intensify, with stakeholders seeking solutions that not only enhance operational efficiency but also provide a favorable return on investment. This trend is expected to drive further innovation and adoption within the pharmacy automation market.

Technological Advancements in Automation

Technological advancements are significantly shaping the pharmacy automation market. Innovations in artificial intelligence (AI) and machine learning are enhancing the capabilities of automation systems, enabling more accurate medication dispensing and inventory management. In the GCC, the integration of these technologies is expected to increase operational efficiency by up to 30% over the next five years. Furthermore, the development of user-friendly interfaces and mobile applications is facilitating easier adoption of automation solutions among pharmacy staff. As these technologies continue to evolve, they are likely to drive further investment in the pharmacy automation market, as stakeholders recognize the potential for improved accuracy and reduced operational costs.

Increased Investment in Healthcare Infrastructure

The pharmacy automation market is benefiting from increased investment in healthcare infrastructure across the GCC. As governments allocate more resources to enhance healthcare services, the demand for advanced pharmacy automation solutions is rising. This investment is aimed at modernizing healthcare facilities, which includes the integration of automated systems for medication dispensing and inventory management. The GCC region is witnessing a healthcare expenditure growth rate of approximately 7% annually, which is likely to bolster the pharmacy automation market. Enhanced infrastructure not only supports the implementation of automation technologies but also fosters an environment conducive to innovation and improved patient care.