Aging Population

The demographic shift towards an aging population in the GCC is a significant factor impacting the pain relief-medication market. As individuals age, they are more susceptible to various health issues, including chronic pain conditions. By 2030, it is estimated that the proportion of individuals aged 60 and above in the GCC will increase to 15%, leading to a higher demand for pain management solutions. This demographic trend suggests that pharmaceutical companies may focus on developing targeted pain relief medications that cater specifically to the elderly. Consequently, the pain relief-medication market is likely to witness substantial growth as it adapts to the needs of an aging population.

Rising Healthcare Expenditure

Healthcare spending in the GCC is on an upward trajectory, which positively influences the pain relief-medication market. Governments in the region are investing heavily in healthcare infrastructure and services, with expenditures projected to reach $100 billion by 2025. This increase in funding allows for better access to medications and treatments for pain management. As healthcare systems evolve, there is a growing emphasis on providing comprehensive pain relief solutions, which is likely to drive the demand for both traditional and novel pain relief medications. Furthermore, the expansion of health insurance coverage in the GCC is expected to facilitate access to these medications, thereby enhancing market growth.

Growing Awareness of Pain Management

There is a notable increase in awareness regarding pain management strategies among healthcare professionals and patients in the GCC. Educational initiatives and campaigns aimed at informing the public about chronic pain and its treatment options are becoming more prevalent. This heightened awareness is likely to lead to an increase in consultations with healthcare providers, resulting in a greater demand for pain relief medications. As patients become more informed about their treatment options, they may actively seek out effective pain management solutions, thereby driving growth in the pain relief-medication market. Additionally, healthcare providers are increasingly recognizing the importance of addressing pain as a critical component of overall health.

Expansion of E-commerce in Healthcare

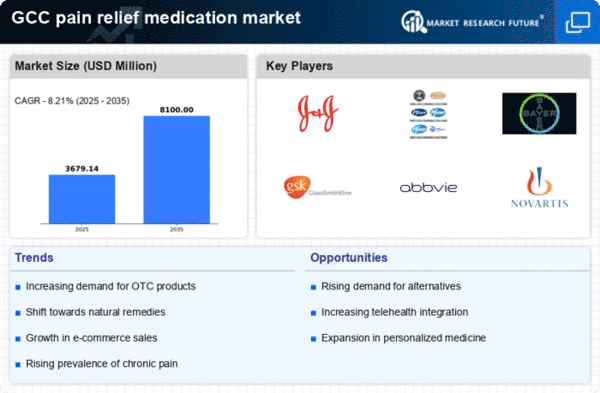

The rise of e-commerce platforms in the healthcare sector is transforming the way consumers access pain relief medications in the GCC. Online pharmacies and health platforms are becoming more popular, providing patients with convenient access to a wide range of pain relief products. This trend is particularly relevant in the context of the GCC, where digital penetration is high, and consumers are increasingly comfortable with online shopping. The convenience of purchasing medications online is likely to enhance the visibility and availability of pain relief options, thereby stimulating growth in the pain relief-medication market. Furthermore, e-commerce platforms often offer competitive pricing and promotions, which may attract more consumers to seek pain relief solutions.

Increasing Prevalence of Chronic Pain

The rising incidence of chronic pain conditions in the GCC region is a primary driver for the pain relief-medication market. Conditions such as arthritis, back pain, and migraines are becoming more common, affecting a significant portion of the population. According to health statistics, approximately 30% of adults in the GCC report experiencing chronic pain, which necessitates effective pain management solutions. This growing patient base is likely to increase the demand for various pain relief medications, including both prescription and over-the-counter options. As healthcare providers seek to address this issue, the pain relief-medication market is expected to expand, with a focus on innovative treatments that cater to the specific needs of patients suffering from chronic pain.