Growing Aging Population

The demographic shift towards an aging population in the GCC region is a critical driver for the ophthalmic viscoelastic devices market. As the population ages, the incidence of age-related eye conditions, such as macular degeneration and cataracts, is anticipated to increase. Reports indicate that by 2026, the proportion of individuals aged 60 and above in the GCC is expected to rise significantly, leading to a higher demand for ophthalmic surgeries. This demographic trend underscores the necessity for effective surgical solutions, including viscoelastic devices, to address the unique challenges posed by age-related eye disorders. Consequently, the market is likely to witness substantial growth as healthcare providers adapt to the needs of this demographic.

Government Initiatives and Funding

Government initiatives aimed at enhancing healthcare infrastructure in the GCC region are playing a pivotal role in the growth of the ophthalmic viscoelastic devices market. Various GCC governments have allocated substantial budgets to improve healthcare services, particularly in ophthalmology. For instance, initiatives to establish specialized eye hospitals and clinics are underway, which are expected to increase the demand for advanced surgical tools, including viscoelastic devices. Furthermore, public health campaigns aimed at raising awareness about eye health are likely to contribute to increased patient visits, thereby further stimulating market growth. The financial backing from governments is crucial in fostering innovation and accessibility in ophthalmic care.

Rising Prevalence of Eye Disorders

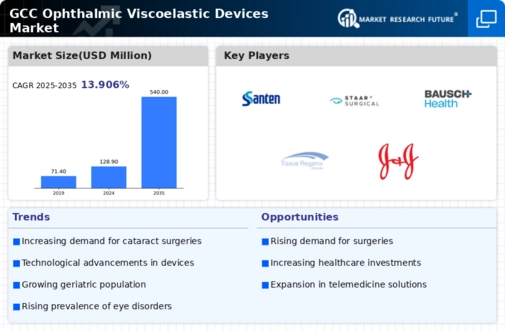

The GCC ophthalmic viscoelastic devices market is experiencing growth due to the increasing prevalence of eye disorders such as cataracts and glaucoma. According to regional health statistics, the incidence of cataracts is projected to rise significantly, with estimates suggesting that by 2026, over 1.5 million cases may be diagnosed annually in the GCC region. This surge in eye-related ailments necessitates advanced surgical interventions, thereby driving demand for viscoelastic devices that facilitate smoother surgical procedures. As healthcare systems in GCC countries enhance their ophthalmic care capabilities, the adoption of these devices is likely to expand, reflecting a broader trend towards improved patient outcomes and surgical efficiency.

Increased Investment in Healthcare Sector

The GCC ophthalmic viscoelastic devices market is benefiting from increased investment in the healthcare sector, driven by both public and private entities. The region has seen a surge in funding aimed at enhancing healthcare facilities and services, particularly in ophthalmology. This influx of capital is facilitating the acquisition of advanced medical technologies, including viscoelastic devices, which are essential for modern surgical practices. Moreover, partnerships between healthcare providers and technology firms are emerging, fostering innovation and improving the quality of care. As investments continue to flow into the healthcare sector, the demand for high-quality ophthalmic viscoelastic devices is expected to rise, reflecting a commitment to improving patient outcomes in the GCC.

Technological Innovations in Surgical Procedures

The GCC ophthalmic viscoelastic devices market is significantly influenced by ongoing technological innovations in surgical procedures. The introduction of minimally invasive techniques and advanced surgical instruments has transformed ophthalmic surgeries, leading to a higher demand for viscoelastic devices that enhance surgical precision and safety. For example, the integration of digital imaging and robotic-assisted surgery is becoming more prevalent in the region, which may lead to improved surgical outcomes. As these technologies continue to evolve, the need for high-quality viscoelastic devices that can support these advanced procedures is expected to grow, indicating a promising future for the market.