Evolving Healthcare Policies

The medical morphine market is influenced by evolving healthcare policies within the GCC. Governments are increasingly recognizing the importance of effective pain management in improving patient quality of life. As a result, there is a push for policies that facilitate access to essential medications, including morphine. Recent initiatives have aimed to streamline the regulatory approval process for opioid medications, which could enhance their availability in healthcare settings. Additionally, the implementation of guidelines for the responsible prescribing of opioids is likely to promote the safe use of morphine, thereby increasing its acceptance among healthcare providers. This shift in healthcare policies may lead to a more robust medical morphine market, as patients gain better access to necessary pain relief options.

Growing Awareness of Palliative Care

The medical morphine market is benefiting from the growing awareness of palliative care in the GCC. As healthcare providers and patients alike become more informed about the importance of palliative care, there is an increasing recognition of the role that morphine plays in managing severe pain associated with terminal illnesses. This awareness is driving demand for morphine prescriptions, as healthcare professionals seek to provide compassionate care to patients in need. Furthermore, educational campaigns aimed at both healthcare providers and the public are likely to enhance understanding of pain management options, including the use of morphine. Consequently, the medical morphine market is expected to expand as palliative care becomes more integrated into healthcare practices across the region.

Advancements in Pharmaceutical Research

Innovations in pharmaceutical research are playing a crucial role in shaping the medical morphine market. Recent developments in drug formulation and delivery systems have enhanced the efficacy and safety profiles of morphine-based medications. For instance, the introduction of extended-release formulations allows for better pain management with fewer side effects, which is particularly beneficial for patients with chronic conditions. The GCC region has seen an increase in research initiatives aimed at optimizing opioid therapies, which could lead to a more favorable perception of morphine among healthcare professionals. As a result, the medical morphine market is likely to benefit from these advancements, potentially increasing its market share within the broader pain management sector. The ongoing research efforts may also pave the way for new applications of morphine, further driving market growth.

Rising Incidence of Chronic Pain Conditions

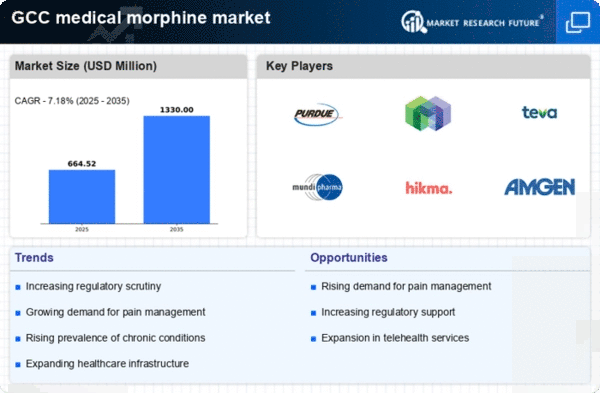

The medical morphine market is growing due to the increasing prevalence of chronic pain conditions in the GCC region.. Conditions such as arthritis, cancer, and neuropathic pain are becoming more common, leading to a heightened demand for effective pain management solutions. According to recent health statistics, approximately 30% of the adult population in the GCC suffers from chronic pain, which necessitates the use of opioids like morphine. This trend indicates a potential expansion in the medical morphine market, as healthcare providers seek to address the needs of patients requiring long-term pain relief. Furthermore, the aging population in the region is likely to exacerbate this issue, as older adults are more susceptible to chronic pain. Thus, the rising incidence of chronic pain conditions is a significant driver for the medical morphine market.

Increased Focus on Pain Management Education

The medical morphine market is experiencing growth due to an increased focus on pain management education among healthcare professionals in the GCC. Training programs and workshops aimed at improving the knowledge and skills of healthcare providers regarding opioid prescribing are becoming more prevalent. This emphasis on education is crucial, as it equips providers with the necessary tools to manage pain effectively while minimizing the risks associated with opioid use. As healthcare professionals become more confident in prescribing morphine, the medical morphine market is likely to see a rise in demand. Additionally, patient education initiatives are also gaining traction, empowering patients to engage in their pain management plans. This dual approach to education is expected to foster a more informed healthcare environment, ultimately benefiting the medical morphine market.