Expansion of Healthcare Facilities

The expansion of healthcare facilities across the GCC is a crucial driver for the interventional radiology-products market. New hospitals and specialized clinics are being established to cater to the growing population and their healthcare needs. This expansion is accompanied by the incorporation of advanced medical technologies, including interventional radiology products, to enhance service offerings. According to recent statistics, the number of healthcare facilities in the GCC is projected to increase by 15% over the next five years. This growth is likely to create a robust demand for interventional radiology products, as these facilities seek to provide comprehensive and cutting-edge care to their patients.

Government Initiatives and Funding

Government initiatives aimed at improving healthcare access and quality in the GCC are playing a pivotal role in the interventional radiology-products market. Increased funding for healthcare infrastructure and technology adoption is evident, as governments recognize the importance of advanced medical technologies in enhancing patient care. For example, the Saudi Vision 2030 plan emphasizes the need for modern healthcare solutions, which includes investments in interventional radiology. Such initiatives are expected to create a favorable environment for the growth of the interventional radiology-products market, as healthcare facilities upgrade their capabilities to meet rising patient demands.

Rising Prevalence of Chronic Diseases

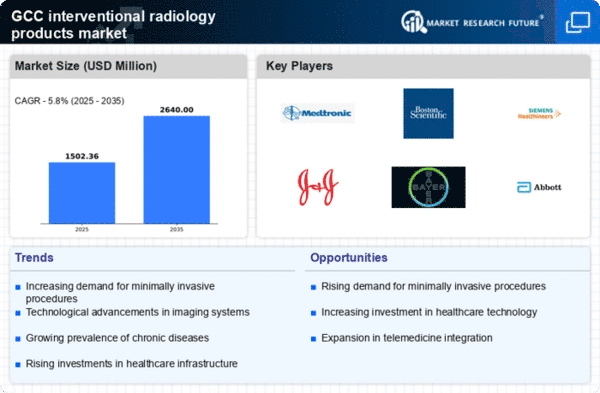

The increasing incidence of chronic diseases such as cardiovascular disorders, cancer, and diabetes in the GCC region is a primary driver for the interventional radiology-products market. As healthcare providers seek effective treatment options, the demand for interventional radiology procedures is likely to rise. For instance, the World Health Organization indicates that non-communicable diseases account for approximately 70% of all deaths in the region. This trend necessitates advanced interventional radiology products to facilitate timely and effective interventions, thereby enhancing patient outcomes. The growing burden of these diseases is expected to propel investments in healthcare infrastructure, further stimulating the interventional radiology-products market.

Growing Awareness and Patient Education

There is a noticeable increase in awareness regarding the benefits of interventional radiology among both healthcare professionals and patients in the GCC. Educational campaigns and outreach programs are helping to inform the public about minimally invasive procedures and their advantages over traditional surgical methods. This heightened awareness is likely to lead to an increase in patient inquiries and requests for interventional radiology services. As patients become more informed, the demand for interventional radiology-products is expected to rise, thereby driving market growth. The interventional radiology-products market is poised to benefit from this trend as healthcare providers adapt to meet the evolving needs of their patients.

Technological Innovations in Imaging Techniques

Advancements in imaging technologies, such as MRI, CT, and ultrasound, are significantly influencing the interventional radiology-products market. Enhanced imaging capabilities allow for more precise diagnosis and treatment planning, which is crucial for successful interventional procedures. The integration of artificial intelligence and machine learning into imaging systems is also emerging, potentially improving accuracy and efficiency. According to recent data, the imaging market in the GCC is projected to grow at a CAGR of 8% over the next five years. This growth is likely to drive demand for innovative interventional radiology products that leverage these advanced imaging techniques, thereby enhancing procedural outcomes.