Cost-Containment Initiatives

Healthcare systems in the GCC are increasingly focused on cost-containment strategies, which significantly influence the insulin biosimilars market. Governments and health authorities are implementing policies aimed at reducing healthcare expenditures, particularly in the management of chronic diseases like diabetes. The introduction of biosimilars, which are typically priced lower than their reference biologics, aligns with these initiatives. For instance, the potential savings from switching to biosimilars can be substantial, with estimates indicating that biosimilars could reduce costs by up to 30%. This financial incentive encourages healthcare providers to adopt biosimilars, thereby expanding their market presence and improving patient access to essential medications.

Growing Prevalence of Diabetes

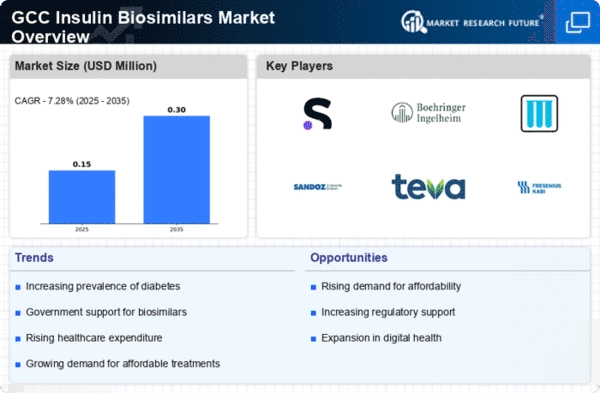

The rising incidence of diabetes in the GCC region is a primary driver for the insulin biosimilars market. According to health statistics, the prevalence of diabetes in the GCC countries has reached alarming levels, with estimates suggesting that around 20% of the adult population is affected. This increasing patient population necessitates the availability of effective and affordable treatment options, thereby propelling the demand for insulin biosimilars. As healthcare systems strive to manage this growing burden, the insulin biosimilars market is likely to expand significantly, providing patients with more accessible alternatives to traditional insulin therapies. The focus on diabetes management is expected to drive investments in research and development. This will further enhance the market landscape.

Regulatory Support for Biosimilars

Regulatory frameworks in the GCC are increasingly supportive of the development and approval of biosimilars, which is a crucial driver for the insulin biosimilars market. Authorities are establishing clear guidelines that facilitate the entry of biosimilars into the market, ensuring that they meet safety and efficacy standards. This regulatory support not only accelerates the approval process but also instills confidence among healthcare providers and patients regarding the use of biosimilars. As more biosimilars gain regulatory approval, the market is likely to see a surge in competition, which could lead to lower prices and improved access to insulin therapies for patients across the region.

Technological Advancements in Biologics

Technological innovations in the production and formulation of biologics are driving the insulin biosimilars market in the GCC. Advances in biotechnology have led to improved methods for developing biosimilars, enhancing their efficacy and safety profiles. These innovations not only streamline the manufacturing process but also reduce production costs, making biosimilars more competitive in the market. As a result, The insulin biosimilars market is witnessing an influx of new products. These products meet stringent regulatory standards. The ongoing research in biologics is expected to yield more sophisticated insulin formulations, further stimulating market growth and providing patients with a wider array of treatment options.

Increasing Patient Awareness and Acceptance

There is a notable increase in patient awareness and acceptance of biosimilars in the GCC, which serves as a significant driver for the insulin biosimilars market. Educational initiatives by healthcare providers and organizations are helping patients understand the benefits and safety of biosimilars compared to traditional insulin products. As patients become more informed, their willingness to consider biosimilars as viable treatment options grows. This shift in perception is crucial, as it can lead to higher adoption rates of biosimilars, ultimately expanding the market. The trend towards patient empowerment in healthcare decisions is likely to continue influencing the insulin biosimilars market positively.