Government Initiatives and Funding

Government initiatives play a crucial role in shaping the Government initiatives play a crucial role in shaping the hospital services market.. In the GCC, various governments are increasing their healthcare budgets, with allocations reaching up to 10% of national expenditures. This funding is directed towards enhancing hospital infrastructure, expanding service offerings, and improving healthcare accessibility. Such initiatives are likely to stimulate growth in the hospital services market, as they enable hospitals to invest in state-of-the-art technology and recruit skilled personnel. Furthermore, the establishment of health policies aimed at improving public health outcomes suggests a long-term commitment to enhancing the quality of care provided in hospitals, thereby fostering a more robust hospital services market.

Integration of Telemedicine Solutions

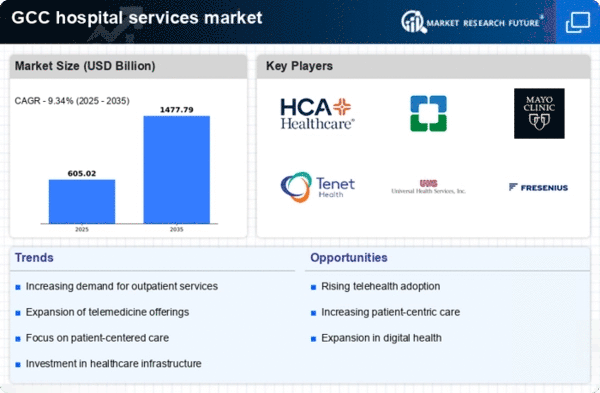

The integration of telemedicine solutions is transforming the The integration of telemedicine solutions is transforming healthcare delivery., particularly in the GCC region. As healthcare providers increasingly adopt digital health technologies, telemedicine is becoming a vital component of service delivery. This shift is driven by the need for accessible healthcare, especially in remote areas. Market data suggests that telemedicine services could account for up to 20% of outpatient visits by 2026. The convenience and efficiency of telemedicine not only enhance patient satisfaction but also optimize hospital resources. As hospitals invest in telehealth platforms, the hospital services market is likely to expand, offering patients a broader range of services while improving operational efficiency.

Rising Demand for Specialized Services

The The hospital services market is experiencing a notable increase in demand for specialized medical services. is experiencing a notable increase in demand for specialized medical services, driven by a growing population and an increase in chronic diseases. In the GCC region, the prevalence of conditions such as diabetes and cardiovascular diseases has surged, necessitating advanced treatment options. This trend is reflected in the market data, which indicates that specialized services account for approximately 30% of total hospital revenues. As healthcare providers adapt to these demands, investments in specialized facilities and training for healthcare professionals are likely to rise, further enhancing the hospital services market. The focus on specialized care not only improves patient outcomes but also positions hospitals as leaders in innovative treatment methodologies.

Focus on Quality and Accreditation Standards

The emphasis on quality and accreditation standards is reshaping the The emphasis on quality and accreditation standards is reshaping healthcare delivery.. In the GCC, hospitals are increasingly seeking accreditation from recognized bodies to enhance their reputation and ensure compliance with international standards. This focus on quality is driven by patient expectations and regulatory requirements. Hospitals that achieve accreditation often experience improved patient outcomes and operational efficiencies, which can lead to increased market share. The hospital services market is likely to benefit from this trend, as accredited facilities attract more patients and foster trust within the community. As a result, the pursuit of quality and accreditation is becoming a pivotal driver in the evolution of the hospital services market.

Aging Population and Increased Healthcare Needs

The aging population in the GCC is a significant driver of the The aging population in the GCC is a significant driver of healthcare services.. As life expectancy rises, the demand for healthcare services is expected to increase substantially. By 2030, it is projected that the elderly population will constitute over 15% of the total population in several GCC countries. This demographic shift is likely to lead to a higher incidence of age-related health issues, thereby increasing the need for hospital services. Hospitals may need to adapt their service offerings to cater to this demographic, which could involve expanding geriatric care and rehabilitation services. Consequently, the hospital services market is poised for growth as it responds to the evolving healthcare needs of an aging population.