Rising Cybersecurity Threats

The increasing frequency and sophistication of cyberattacks has emerged as a critical driver for the disaster recovery-service market. Organizations in the GCC are recognizing the necessity of robust disaster recovery solutions to safeguard their data and maintain operational continuity. In 2025, it is estimated that cybercrime could cost businesses globally over $10 trillion annually, prompting GCC companies to invest heavily in disaster recovery services. This trend indicates a growing awareness of the vulnerabilities associated with digital transformation, leading to a heightened demand for comprehensive recovery strategies. As businesses strive to protect sensitive information, The disaster recovery market is likely to experience significant growth. This growth is driven by the need for advanced security measures and recovery protocols.

Increased Regulatory Scrutiny

Regulatory frameworks in the GCC are becoming more stringent, compelling organizations to adopt comprehensive disaster recovery plans. Compliance with these regulations is essential for avoiding penalties and ensuring operational integrity. The disaster recovery-service market is experiencing growth as businesses invest in solutions that align with regulatory requirements. In 2025, it is anticipated that compliance-related expenditures will account for a significant portion of IT budgets in the region. This trend underscores the importance of disaster recovery services in helping organizations navigate complex regulatory landscapes while safeguarding their assets and reputation.

Natural Disaster Preparedness

The GCC region is increasingly susceptible to natural disasters, including floods, earthquakes, and extreme weather events. This reality has catalyzed a surge in demand for disaster recovery services, as organizations seek to mitigate risks and ensure business continuity. According to recent assessments, the economic impact of natural disasters in the GCC could reach billions of dollars annually. Consequently, businesses are prioritizing investments in disaster recovery solutions to enhance their resilience against such events. The disaster recovery-service market is thus positioned to expand, as companies recognize the importance of preparedness and recovery planning in the face of unpredictable environmental challenges.

Growing Awareness of Business Continuity

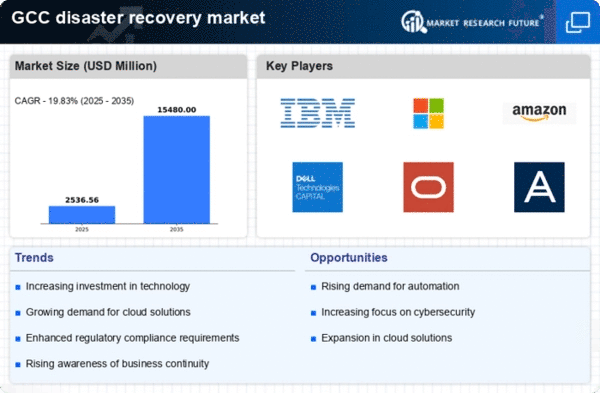

There is a notable shift in organizational culture towards prioritizing business continuity planning within the GCC. Companies are increasingly recognizing that effective disaster recovery strategies are integral to sustaining operations during crises. This awareness is driving demand for disaster recovery services, as organizations seek to develop comprehensive plans that encompass risk assessment, response strategies, and recovery protocols. In 2025, it is projected that investments in business continuity solutions will rise significantly, reflecting a broader understanding of the potential impacts of disruptions. The disaster recovery-service market is thus poised for growth, as businesses strive to enhance their resilience and ensure long-term sustainability.

Technological Advancements in Recovery Solutions

Innovations in technology are reshaping the landscape of the disaster recovery-service market. The integration of cloud computing, artificial intelligence, and automation into recovery solutions is enhancing efficiency and effectiveness. In 2025, the cloud-based disaster recovery market is projected to grow at a CAGR of over 20% in the GCC, reflecting the increasing reliance on scalable and flexible recovery options. These advancements enable organizations to recover data swiftly and minimize downtime, which is crucial for maintaining competitive advantage. As businesses adopt these cutting-edge technologies, the disaster recovery-service market is likely to witness substantial growth, driven by the demand for modernized recovery strategies.