Growing Healthcare Expenditure

Healthcare expenditure in the GCC region is on the rise, driven by increasing population health needs and a growing emphasis on advanced medical treatments. The biotechnology pharmaceutical-services-outsources market is likely to benefit from this trend, as governments allocate more resources to healthcare infrastructure and services. In 2025, healthcare spending in the GCC is projected to reach approximately $200 billion, with a significant portion directed towards biopharmaceutical innovations. This increase in funding may lead to greater demand for biotechnology services, as healthcare providers seek to incorporate cutting-edge therapies into their treatment protocols.

Regulatory Support and Frameworks

The biotechnology pharmaceutical-services-outsources market benefits from supportive regulatory frameworks established by GCC governments. These frameworks aim to foster innovation and ensure the safety and efficacy of biopharmaceutical products. For example, the Saudi Food and Drug Authority (SFDA) has implemented guidelines that facilitate the approval process for new biologics, thereby reducing time-to-market. This regulatory environment encourages investment in biotechnology, as companies are more likely to engage in research and development activities when they perceive a clear pathway to regulatory approval. Consequently, the biotechnology pharmaceutical-services-outsources market is poised for growth as regulatory bodies continue to adapt to the evolving landscape of biopharmaceuticals.

Rising Incidence of Chronic Diseases

The biotechnology pharmaceutical-services-outsources market is significantly influenced by the rising incidence of chronic diseases in the GCC region. Conditions such as diabetes, cardiovascular diseases, and cancer are becoming increasingly prevalent, necessitating the development of innovative therapeutic solutions. The World Health Organization (WHO) indicates that chronic diseases account for over 70% of deaths in the region, highlighting the urgent need for effective treatments. This growing health crisis is likely to drive demand for biopharmaceutical products and services, as healthcare systems seek to address these challenges through advanced biotechnology solutions.

Increased Focus on Research and Development

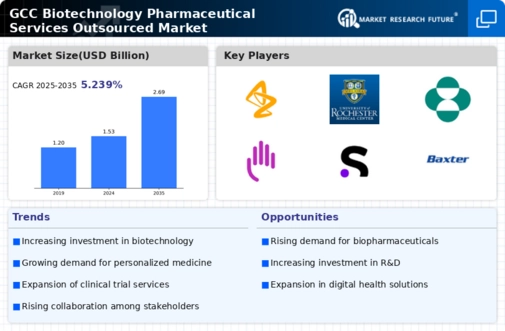

Investment in research and development (R&D) within the biotechnology pharmaceutical-services-outsources market is intensifying, as companies recognize the importance of innovation in maintaining competitive advantage. In the GCC, R&D spending in the biotechnology sector has seen a notable increase, with estimates suggesting a growth rate of around 15% annually. This focus on R&D is essential for developing new therapies and improving existing ones, particularly in the face of evolving health challenges. As companies prioritize R&D, the biotechnology pharmaceutical-services-outsources market is expected to expand, driven by the continuous introduction of novel biopharmaceutical products.

Technological Advancements in Biotechnology

The biotechnology pharmaceutical-services-outsources market is experiencing a surge in technological advancements, particularly in areas such as gene editing and synthetic biology. These innovations are enhancing the efficiency and effectiveness of drug development processes. For instance, CRISPR technology has revolutionized genetic engineering, allowing for precise modifications that can lead to novel therapeutic solutions. In the GCC region, investments in biotechnology research and development have increased, with funding reaching approximately $1 billion in recent years. This influx of capital is likely to accelerate the growth of the biotechnology pharmaceutical-services-outsources market, as companies leverage cutting-edge technologies to streamline operations and improve product offerings.