Enhanced Connectivity Solutions

The 5g industrial-iot market is experiencing a surge in demand for enhanced connectivity solutions. This is primarily driven by the need for real-time data transmission and communication across various industrial sectors. In the GCC, industries such as oil and gas, manufacturing, and logistics are increasingly adopting 5G technology to improve operational efficiency. The ability to connect a vast number of devices simultaneously, with low latency, is crucial for these sectors. Reports indicate that the 5g industrial-iot market could see a growth rate of approximately 25% annually as companies seek to leverage advanced connectivity for automation and data analytics. Enhanced connectivity not only facilitates better communication but also supports the integration of AI and machine learning, further driving innovation in industrial processes.

Increased Focus on Data Security

In the context of the 5g industrial-iot market, increased focus on data security is becoming increasingly critical. As industries adopt more connected devices and systems, the potential for cyber threats escalates. In the GCC, companies are recognizing the importance of securing their data and networks against breaches. This has led to a heightened demand for advanced security solutions that can protect sensitive information transmitted over 5G networks. The market for cybersecurity in the industrial sector is projected to grow significantly, with estimates indicating a potential increase of 20% annually. This focus on data security not only safeguards industrial operations but also builds trust among stakeholders, facilitating broader adoption of 5G technologies in various sectors.

Government Initiatives and Investments

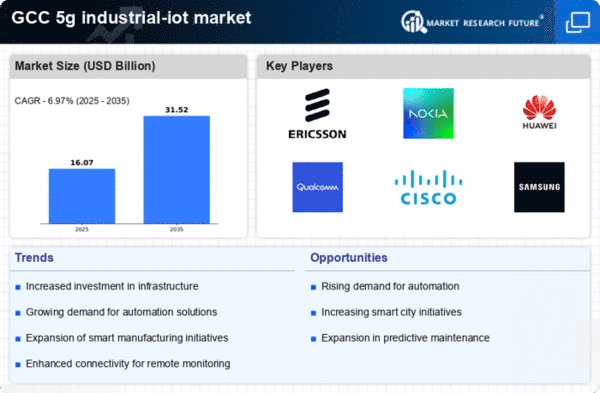

Government initiatives and investments play a pivotal role in the growth of the 5g industrial-iot market. In the GCC, various governments are actively promoting digital transformation strategies that prioritize the adoption of advanced technologies, including 5G. For instance, initiatives aimed at diversifying economies and reducing reliance on oil revenues have led to increased funding for technology infrastructure. The UAE and Saudi Arabia have announced substantial investments in 5G networks, which are expected to enhance industrial capabilities. These investments are projected to reach billions of dollars over the next few years, significantly impacting the 5g industrial-iot market. Such government support not only accelerates the deployment of 5G technology but also encourages private sector participation, fostering a conducive environment for innovation and growth.

Integration of AI and Machine Learning

The integration of AI and machine learning technologies is a transformative driver for the 5g industrial-iot market. These technologies enable industries to analyze vast amounts of data generated by connected devices in real-time, leading to more informed decision-making. In the GCC, sectors such as manufacturing and energy are increasingly leveraging AI to optimize processes and enhance productivity. The synergy between 5G and AI allows for advanced analytics, predictive maintenance, and improved operational efficiency. The 5g industrial-iot market is likely to see substantial growth as companies invest in AI-driven solutions, with projections suggesting a market expansion of around 35% over the next few years. This integration not only enhances operational capabilities but also positions industries to adapt to future challenges and opportunities.

Rising Demand for Automation and Robotics

The rising demand for automation and robotics is a key driver of the 5g industrial-iot market. As industries in the GCC strive for greater efficiency and productivity, the integration of automated systems and robotics has become essential. 5G technology enables seamless communication between machines, allowing for real-time monitoring and control. This is particularly relevant in sectors such as manufacturing and logistics, where automation can lead to significant cost savings and improved operational performance. The 5g industrial-iot market is expected to benefit from this trend, with estimates suggesting that the market could grow by over 30% in the coming years as companies increasingly invest in automated solutions. The ability to deploy advanced robotics powered by 5G will likely transform traditional industrial processes, enhancing competitiveness in the region.