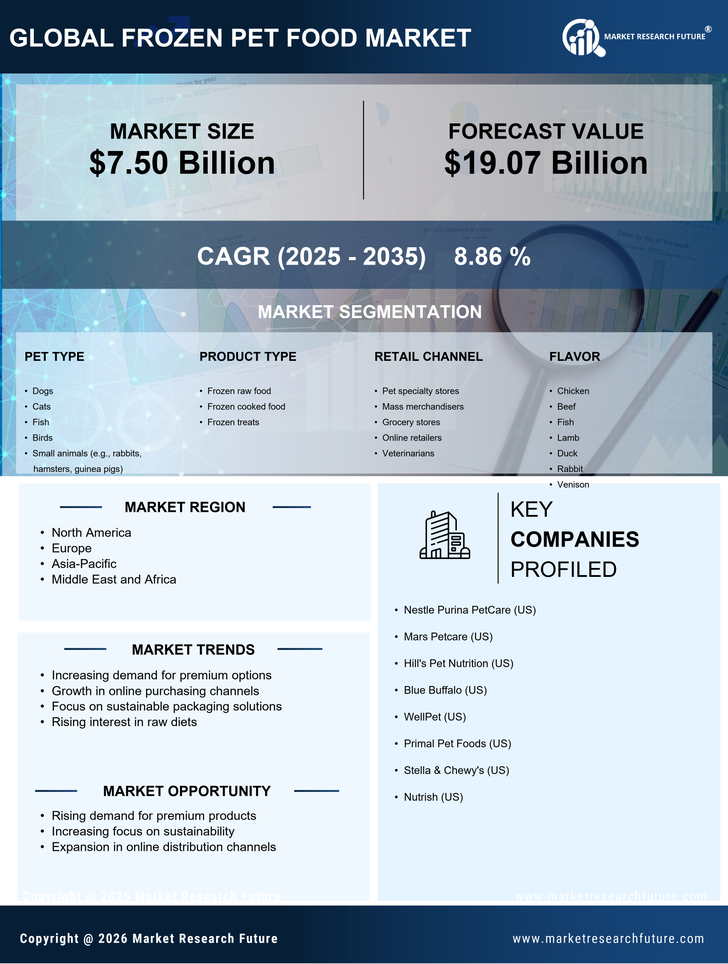

The Frozen Pet Food Market is currently characterized by a dynamic competitive landscape, driven by increasing consumer demand for high-quality, nutritious pet food options. Key players such as Nestle Purina PetCare (US), Mars Petcare (US), and Blue Buffalo (US) are strategically positioned to capitalize on this trend. Nestle Purina PetCare (US) focuses on innovation and product diversification, continuously expanding its portfolio to include premium frozen options that cater to health-conscious pet owners. Mars Petcare (US) emphasizes sustainability and ethical sourcing, aligning its operations with consumer preferences for environmentally friendly products. Blue Buffalo (US), known for its natural ingredients, is enhancing its market presence through targeted marketing campaigns that highlight the benefits of frozen pet food, thereby shaping the competitive environment towards quality and transparency.

In terms of business tactics, companies are increasingly localizing manufacturing to reduce supply chain complexities and enhance responsiveness to market demands. The Frozen Pet Food Market appears moderately fragmented, with several key players exerting influence while also allowing room for niche brands to thrive. This structure fosters a competitive atmosphere where innovation and quality are paramount, as companies strive to differentiate themselves in a crowded marketplace.

In August 2025, Mars Petcare (US) announced a partnership with a leading technology firm to develop an AI-driven platform aimed at optimizing supply chain logistics. This strategic move is likely to enhance operational efficiency and reduce costs, positioning Mars Petcare to better meet the growing demand for frozen pet food. The integration of AI into their supply chain could also facilitate more accurate forecasting and inventory management, ultimately benefiting consumers through improved product availability.

In September 2025, Blue Buffalo (US) launched a new line of frozen pet food products that incorporate locally sourced ingredients, reflecting a growing trend towards transparency and sustainability. This initiative not only aligns with consumer preferences but also strengthens Blue Buffalo's brand identity as a provider of high-quality, natural pet food. The emphasis on local sourcing may resonate well with environmentally conscious consumers, potentially driving sales and enhancing customer loyalty.

In October 2025, Nestle Purina PetCare (US) unveiled a new marketing campaign focused on the health benefits of frozen pet food, leveraging social media platforms to engage with pet owners. This campaign is indicative of a broader trend where companies are increasingly utilizing digital channels to connect with consumers. By emphasizing the nutritional advantages of their products, Nestle Purina PetCare aims to solidify its market position and attract a health-oriented customer base.

As of October 2025, the competitive trends within the Frozen Pet Food Market are heavily influenced by digitalization, sustainability, and technological integration. Strategic alliances are becoming more prevalent, as companies recognize the value of collaboration in enhancing product offerings and operational capabilities. Looking ahead, competitive differentiation is likely to evolve from traditional price-based strategies to a focus on innovation, technology adoption, and supply chain reliability. This shift underscores the importance of adapting to consumer preferences and market dynamics in a rapidly changing landscape.