Integration of Advanced Technologies

The integration of advanced technologies is a pivotal driver in the retail analytics market in France. Retailers are increasingly adopting technologies such as the Internet of Things (IoT) and big data analytics to enhance their operational capabilities. For instance, IoT devices facilitate real-time data collection from various touchpoints, allowing retailers to monitor inventory levels and customer interactions more effectively. This technological evolution is expected to propel the retail analytics market, with projections indicating a growth rate of around 15% annually over the next five years. As retailers harness these technologies, they can gain deeper insights into consumer behavior, leading to more effective marketing strategies and improved customer engagement.

Rise of E-commerce and Omnichannel Strategies

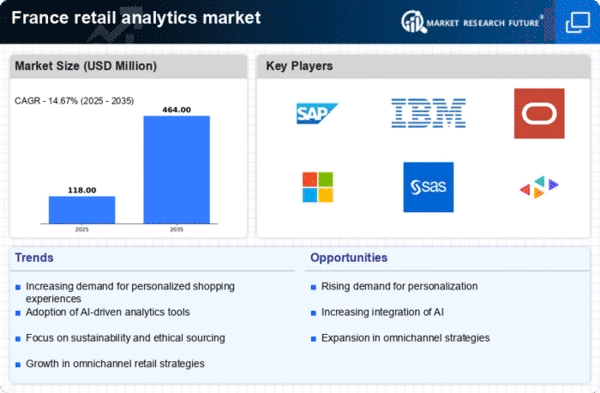

The rise of e-commerce and omnichannel strategies is reshaping the retail analytics market in France. As more consumers shift towards online shopping, retailers are compelled to adopt analytics solutions that provide insights across multiple channels. This trend is reflected in the fact that e-commerce sales in France are projected to reach €130 billion by 2026, prompting retailers to invest in analytics tools that can track customer interactions across both online and offline platforms. By understanding how customers engage with their brands through various channels, retailers can create cohesive shopping experiences that drive sales. Consequently, the retail analytics market is expected to expand as businesses seek to optimize their omnichannel strategies.

Growing Demand for Data-Driven Decision Making

The retail analytics market in France is seeing a significant increase in demand for data-driven decision-making.. Retailers are increasingly recognizing the value of leveraging data analytics. This enhances operational efficiency and optimizes inventory management. According to recent studies, approximately 70% of retailers in France are investing in analytics tools to gain insights into consumer behavior and preferences. This trend is likely to continue as businesses seek to improve their competitive edge. The ability to analyze sales data, customer interactions, and market trends enables retailers to make informed decisions that can lead to increased profitability. Consequently, the retail analytics market is poised for growth as more companies adopt data-centric strategies to navigate the complexities of the retail landscape.

Regulatory Compliance and Data Privacy Concerns

Regulatory compliance and data privacy concerns are significant factors influencing the retail analytics market in France. With the implementation of stringent data protection regulations, such as the General Data Protection Regulation (GDPR), retailers must navigate complex compliance landscapes. This has led to an increased focus on secure data handling practices and the adoption of analytics solutions that prioritize data privacy. Retailers are investing in technologies that ensure compliance while still enabling them to derive valuable insights from customer data. As a result, the retail analytics market is likely to see a shift towards solutions that balance data utility with privacy, fostering trust among consumers and enhancing brand loyalty.

Emphasis on Customer Insights and Behavior Analysis

In the retail analytics market, there is a growing emphasis on understanding customer insights and behavior analysis. Retailers in France are increasingly utilizing analytics to decipher consumer preferences and purchasing patterns. This focus on customer-centric strategies is evident, as approximately 60% of retailers are investing in tools that provide detailed insights into customer journeys. By analyzing data from various sources, including social media and online transactions, retailers can tailor their offerings to meet the specific needs of their clientele. This trend not only enhances customer satisfaction but also drives sales growth, thereby contributing to the overall expansion of the retail analytics market.