North America : Financial Powerhouse

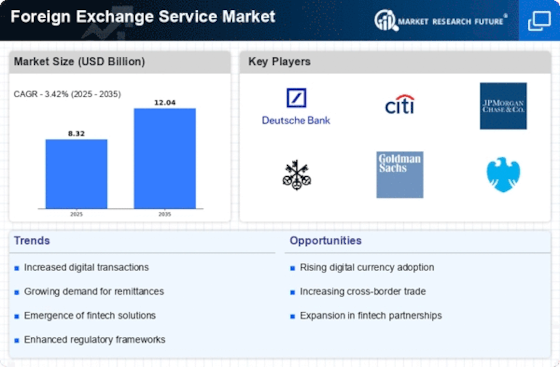

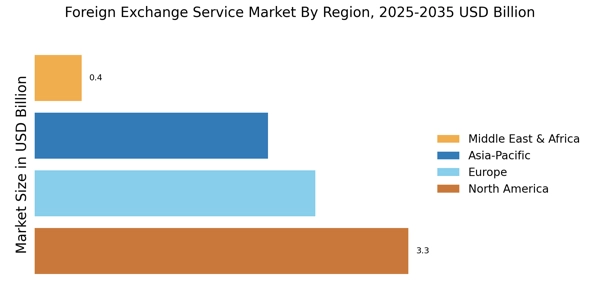

North America is the largest market for foreign exchange services, holding approximately 40% of the global market share. The region's growth is driven by a robust financial infrastructure, increasing cross-border trade, and advancements in technology. Regulatory frameworks, such as the Dodd-Frank Act, have also catalyzed market growth by enhancing transparency and reducing systemic risks. The demand for foreign exchange services is expected to rise as businesses expand internationally and seek efficient currency management solutions. The United States is the leading country in this region, with major players like Citigroup, JPMorgan Chase, and Goldman Sachs dominating the landscape. Canada also plays a significant role, contributing to the market with its stable economy and strong banking sector. The competitive landscape is characterized by a mix of traditional banks and fintech companies, all vying for market share through innovative solutions and improved customer experiences.

Europe : Regulatory Landscape

Europe is the second-largest market for foreign exchange services, accounting for approximately 30% of the global market share. The region's growth is fueled by the increasing need for currency risk management and the expansion of multinational corporations. Regulatory initiatives, such as the Markets in Financial Instruments Directive (MiFID II), have enhanced market transparency and investor protection, driving demand for foreign exchange services across member states. The ongoing economic recovery post-pandemic is also contributing to market growth. Leading countries in Europe include the United Kingdom, Germany, and France, with key players like Deutsche Bank, Barclays, and BNP Paribas. The competitive landscape is marked by a mix of established banks and emerging fintech firms, all striving to innovate and capture market share. The presence of a diverse range of financial institutions fosters a dynamic environment, encouraging competition and enhancing service offerings for clients.

Asia-Pacific : Emerging Market Potential

Asia-Pacific is witnessing rapid growth in the foreign exchange services market, holding approximately 25% of the global market share. The region's expansion is driven by increasing international trade, foreign investments, and a growing number of multinational corporations. Countries like China and India are leading this growth, supported by favorable regulatory environments and technological advancements in financial services. The demand for efficient currency exchange solutions is expected to rise as businesses seek to navigate complex global markets. China, Japan, and Australia are the leading countries in this region, with major players like HSBC and UBS actively participating in the market. The competitive landscape is characterized by a mix of traditional banks and innovative fintech companies, all aiming to enhance their service offerings. The presence of a diverse range of financial institutions fosters a dynamic environment, encouraging competition and improving customer experiences.

Middle East and Africa : Resource-Rich Opportunities

The Middle East and Africa region is emerging as a significant player in the foreign exchange services market, accounting for approximately 5% of the global market share. The growth is driven by increasing trade activities, foreign investments, and the region's strategic geographical position. Regulatory frameworks are evolving to support market development, with initiatives aimed at enhancing transparency and attracting foreign investment. The demand for foreign exchange services is expected to grow as economies diversify and integrate into the global market. Leading countries in this region include South Africa, the United Arab Emirates, and Nigeria, with key players like Standard Bank and First Abu Dhabi Bank. The competitive landscape is characterized by a mix of established banks and new entrants, all striving to capture market share through innovative solutions. The presence of a diverse range of financial institutions fosters a dynamic environment, encouraging competition and enhancing service offerings for clients.